Tired of Watching Your Portfolio Drift While "Experts" Get Rich?

There's a mechanical system that buys low and sells high automatically—no guessing, no emotion, no complex analysis. It's called MicroRebalancing, and you can learn it right here.

Most investors do one of two things: buy-and-hold passively (and watch gains evaporate in corrections), or trade actively (and lose money trying to time the market). MicroRebalancing is the third path—a disciplined, rules-based approach that captures volatility systematically.

✓ Backtested across 30 years of market data

✓ Executed in real accounts through all market conditions

✓ No predictions or market timing required

Choose Your Starting Point

✨New to systematic investing? Start with Index Rebalancing—apply the system to index ETFs like SPY and QQQ with lower risk and simpler execution.

✨Ready for maximum performance? Master the full MicroRebalancing system with individual stocks, dynamic optimization, and technical indicator integration.

Build Your Strategy: Start Simple or Go All-In

🔐 New to Systematic Investing?

-

Build Your Complete Investment System

Master MicroRebalancing in three strategic steps — from foundation to execution to advanced optimization.

Start where you are. Scale when you're ready.

-

✅ Step 1: Build Your Foundation

📗 Investing Made Easy: Introduction to Institutional Style Management

Before you execute trades, understand why the system works.

-

This guide reveals the timeless principles professional fund managers use — asset allocation, risk control, and systematic decision-making — explained in plain language.

You'll learn:

- ✔️ How institutions think about portfolio construction

- ✔️ Why MicroRebalancing fits into proven wealth-building frameworks

- ✔️ Risk management principles that protect your capital

Perfect for: Anyone new to systematic investing or wanting to understand the "why" behind the strategy.

Price: $10 | [Get the Foundation →]

-

✅ Step 2: Start Executing with Lower Risk

📘 Index Rebalancing: Smarter ETF Investing

Apply the MicroRebalancing system to safer, beginner-friendly index ETFs like SPY and QQQ.

This visual, 56-page guide walks you through the complete process with charts, examples, and clear execution rules.

You'll learn:

- ✔️ How to capture profits from volatility without timing the market

- ✔️ Mechanical buy/sell rules that remove emotion from your decisions

- ✔️ The exact strike zones and target allocation framework for ETFs

Perfect for: New systematic investors who want immediate, actionable results with lower complexity.

Regular Price: $10 | Sale Price: $5 | [Start with Index Rebalancing →]

-

✅ Step 3: Master the Full System

📙 The Art of the Micro-Rebalance: A New Financial Frontier

This is the complete playbook. 270+ pages of advanced training, real trade confirmations, simulations, and optimization techniques.

What's inside:

- ✔️ 21 simulations from 1995-2025 showing how MR beat buy-and-hold across bull markets, crashes, and sideways grind

- ✔️ Complete execution framework — the full system for individual stocks and advanced strategies

- ✔️ Real trades tracked through 2020-2022 (bull run, COVID crash, recovery) with documented results

- ✔️ Advanced optimization techniques — dynamic target allocation, technical indicator integration, position sizing

Standard Edition - $15

The complete 270+ page guide with the full MicroRebalancing system. Everything you need to execute the strategy.

-

🔥 Want the Professional Toolkit?

Upgrade to the VIP Access Toolkit ($37) and get:

- ✅ All three books (ISM + IR + MR Standard — $30 value)

- ✅ Pro spreadsheet templates with real historical data

- ✅ Video training series (28 minutes of step-by-step execution)

- ✅ Cash reserve strategy guide — the most overlooked aspect of MR

- ✅ Hidden leveraging techniques — phantom stacking, cascade compounding

- ✅ Educational auto-trading script — see the system logic in code

- ✅ Lifetime access to all future updates

Save $23 + get the complete execution toolkit for serious investors.

-

🎯 Not Sure Where to Start?

New to systematic investing?

Start with Index Rebalancing ($5) — apply the system to ETFs, see results fast, then upgrade when you're ready.

Ready for the complete system?

Get The Art of the Micro-Rebalance Standard Edition ($15) — the full 270+ page guide with everything you need to execute.

Want to understand the foundation first?

Start with Investing Made Easy ($10) — learn institutional principles, then move to execution with confidence.

Serious about mastering MicroRebalancing?

Get the VIP Access Toolkit ($37) — all three books + professional spreadsheets + video training + lifetime updates. The complete system for committed investors.

The future of investing isn't passive — it's precise, mechanical, and systematic.

Most investors drift. You'll outperform.

[Choose Your Starting Point ↴]

-

Investing Made Easy: Introduction to Institutional Style Management

Regular price $10.00 USDRegular price$10.00 USDSale price $10.00 USD -

Index Rebalancing: The Smarter Way to Invest in ETFs

Regular price $5.00 USDRegular price$10.00 USDSale price $5.00 USDSale -

The Art of the Micro-Rebalance: The New Financial Frontier

Regular price $15.00 USDRegular price -

Exclusive VIP Access - All Books | Lifetime Updates | Tools | Scripts | BEST VALUE

Regular price $37.00 USDRegular price

Explore real answers to the most common questions about Micro-Rebalancing | Index Rebalancing

FAQ

What is Micro-Rebalancing (MR)?

What is Micro-Rebalancing?

MR is a unique hybrid of passive and active position management, designed to level the playing field for the modern retail investor.

It leverages recent innovations like fractional shares and zero-commission

trading to achieve remarkable results.

- Proven Performance: MR has delivered CAGRs over 25% on SPY in real accounts and over 40% in simulations utilizing partial-share trading. It consistently beats buy-and-hold across diverse asset types and market scenarios.

- Simple & Repeatable: This system uses basic math to mechanically capture gains at peaks and accumulate shares during drawdowns, eliminating guesswork and emotional decisions. Anyone can do it!

- Real-World Validation: Unlike theoretical models, MR was developed and tested during three years of live trading (2020-2023). All results, including trade blotters and brokerage confirmations, are publicly available for review at: https://indexrebalancing.com/pages/real-world-results.

How Does Micro-Rebalancing Work?

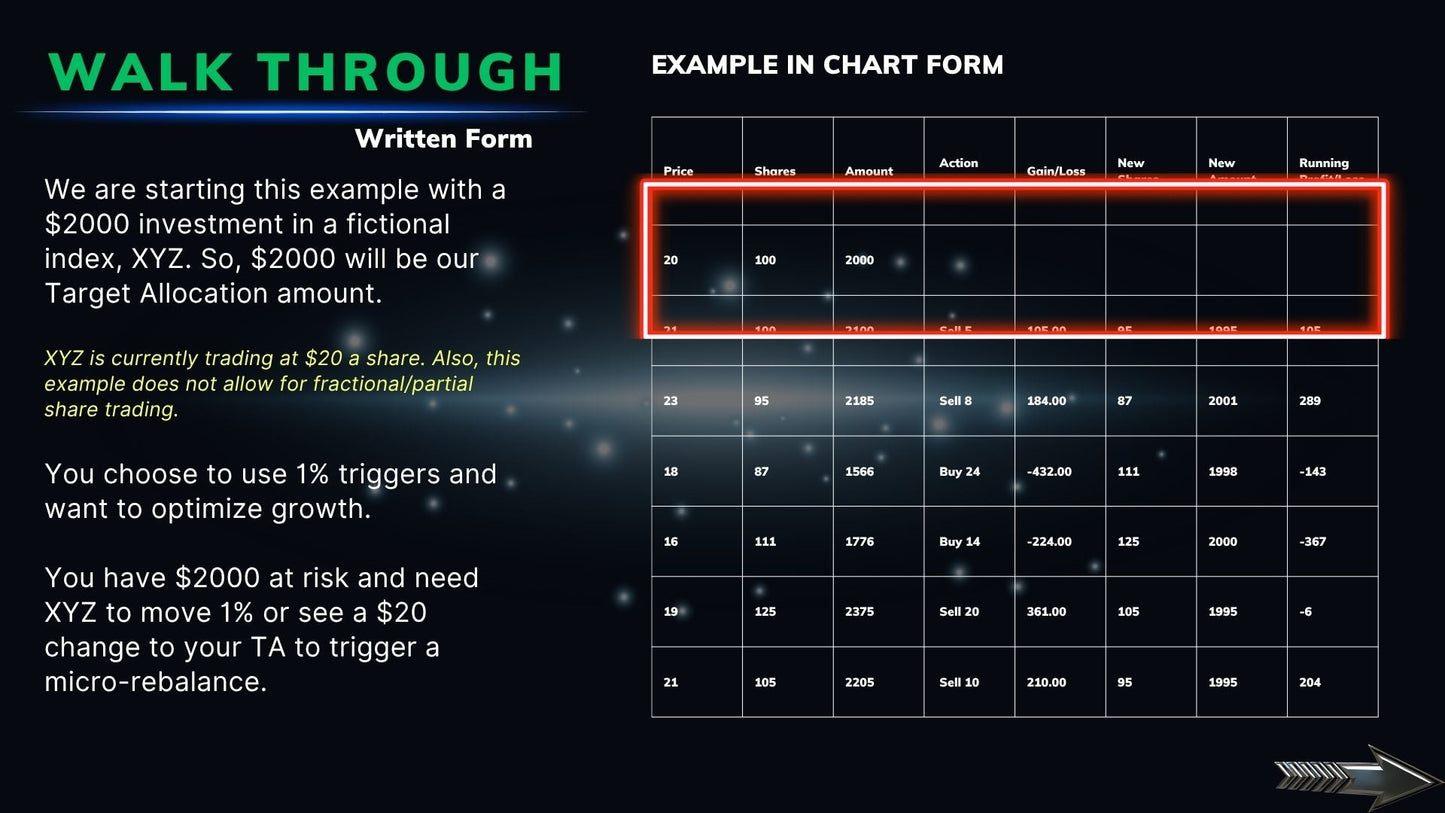

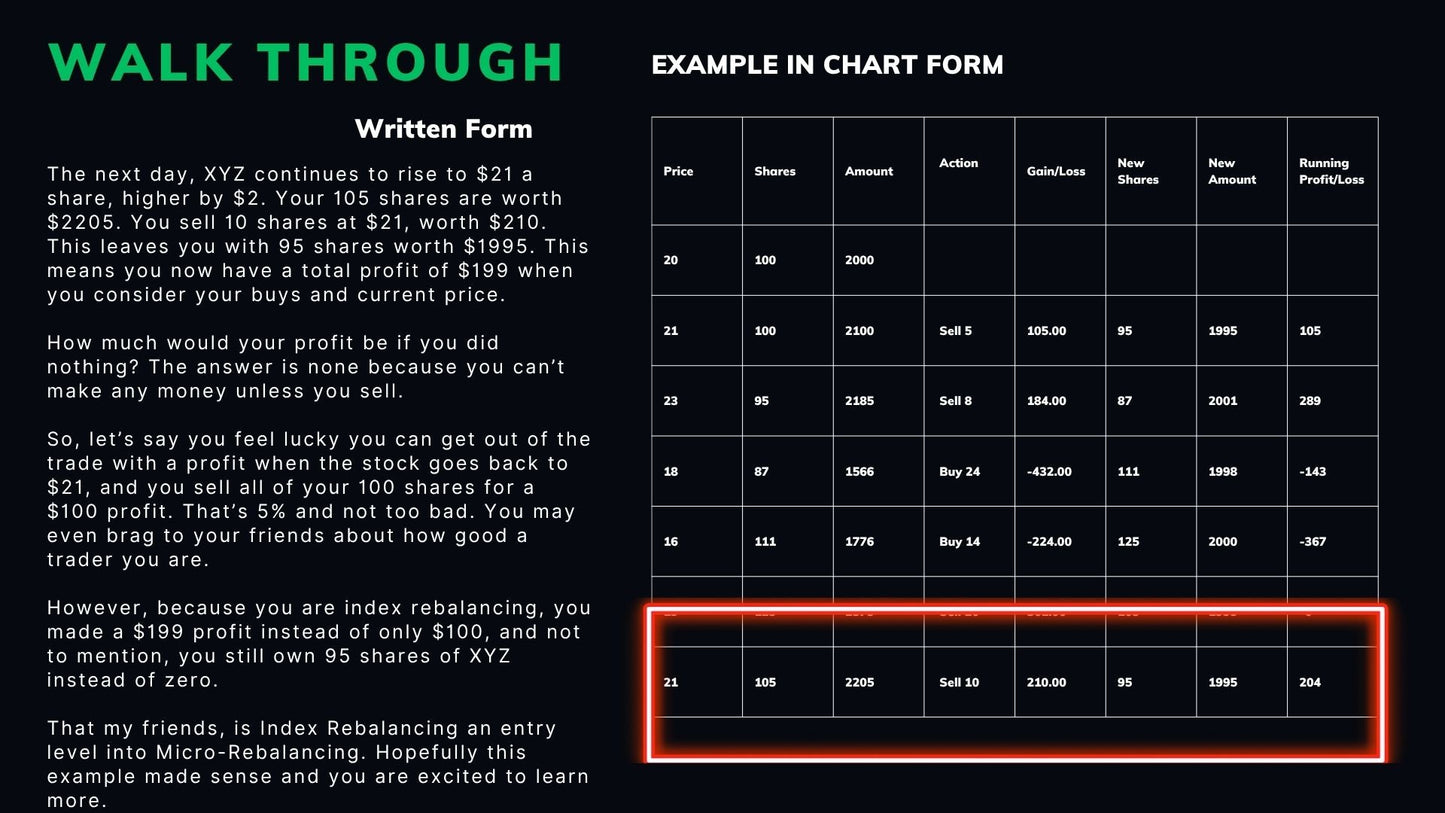

Micro-Rebalancing (MR) is a mechanical, systematic investment method that transforms how you manage individual positions, such as individual stocks or ETFs. Instead of simply buying and holding, MR uses mathematical precision to capture profits from market volatility while building long-term wealth.

Here's how it works: You assign each position a fixed Target Allocation (TA) - essentially a dollar commitment, say $10,000 for SPY. When the market value of your position moves outside a predetermined "strike zone" (perhaps 5% above or below your target), the system triggers automatic action. If your position grows beyond the upper threshold, you mechanically trim shares and bank profits. If it falls below the lower threshold, you accumulate additional shares at lower prices.

This isn't guesswork or market timing - it's pure mathematical logic that forces volatility to work in your favor. While traditional investors watch their gains evaporate during market swings, MR practitioners systematically harvest profits on the way up and accumulate value on the way down.

The beauty of Micro-Rebalancing lies in its mechanical nature. There's no emotion, no predictions about market direction, no complex analysis required. The system tells you exactly when to act and how much to trade. It's like having a disciplined trading robot that never gets scared during crashes or greedy during bubbles.

This approach was impossible for individual investors until recently. Commission-free trading eliminated the cost barrier, while fractional shares made it accessible to investors with any account size. Now, whether you're starting with $1,000 or $100,000, you can implement the same systematic approach that institutions have used for decades.

MR doesn't just help you invest - it teaches you to think like a sophisticated money manager while building wealth through market cycles.

Ready to take it further? Explore the Standard Edition of The Art of Micro-Rebalancing: The New Financial Frontier

or unlock even more tools with the special VIP Access Edition of The Art of the Micro-Rebalance: The New Financial Frontier.

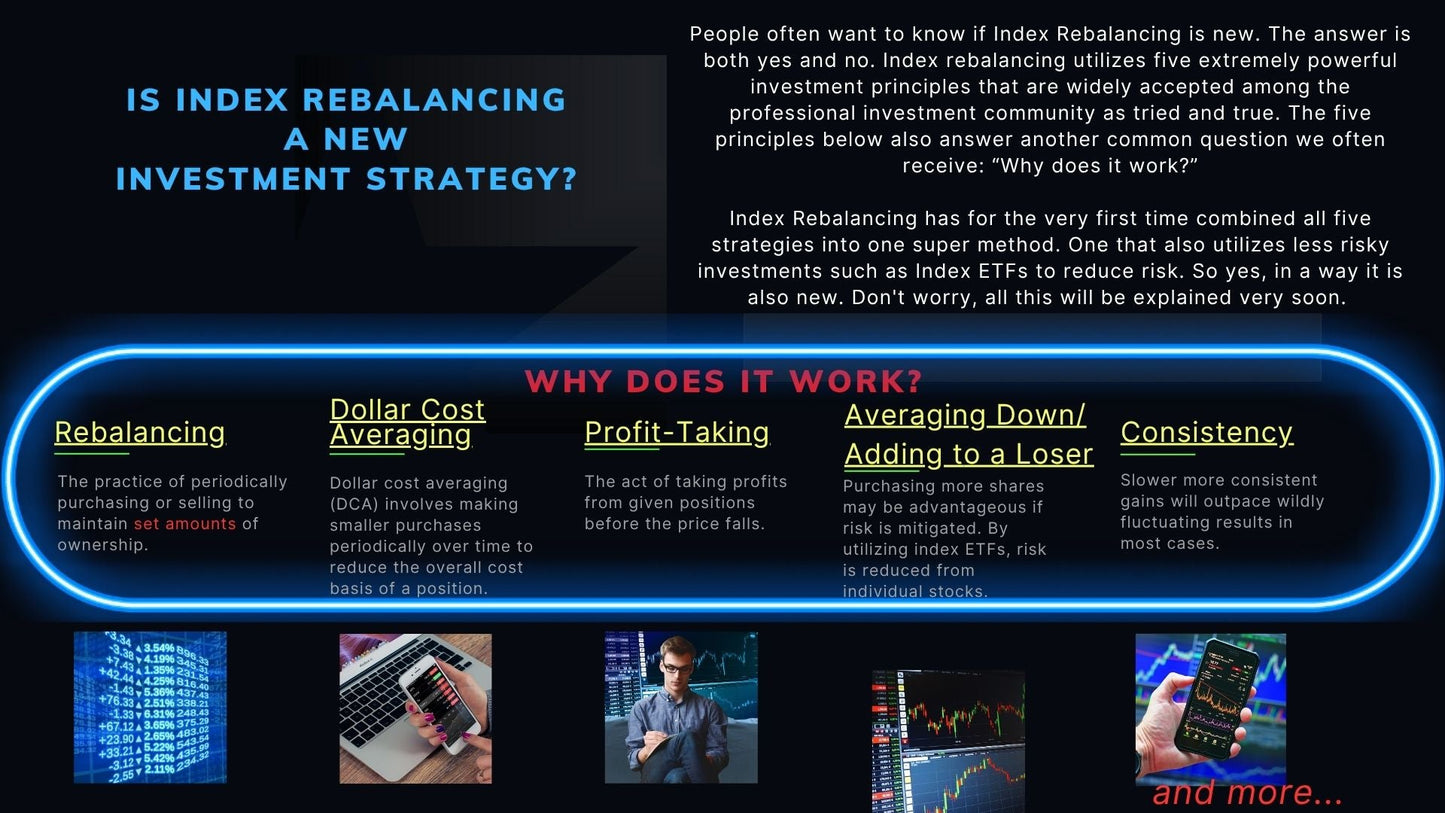

What is Index Rebalancing (IR)?

What is Index Rebalancing (IR)?

Index Rebalancing (IR) is the gateway to Micro-Rebalancing, more focused on applying the simple basics and transforming how you interact with popular index ETFs like VOO or SPY (S&P 500) and QQQ (Nasdaq).

Think of Index Rebalancing: Smarter Index ETF Investing as "MR Lite" – the streamlined version of our comprehensive system that delivers impressive results without requiring advanced financial expertise.

With IR, you'll establish fixed Target Allocations (TA) for your index ETF positions and implement simple percentage-based deviation triggers that tell you exactly when to buy (when positions fall below your lower threshold) and when to sell (when they rise above your upper threshold).

What makes this index ETF investing approach revolutionary?

Traditional index investing leaves your capital at the mercy of market cycles – you're essentially a passenger. With IR, you become the pilot, systematically capturing value from natural market volatility through a logical, mathematics-based framework.

And the best part? You don't need to predict market directions or wrestle with emotional decisions – the system handles that for you.

Micro-Rebalancing (MR) takes these powerful principles to their full potential.

The complete MR system includes 21+ detailed market simulations of repeatable optimizations to increase returns, customizable trigger percentages, option overlays, and sophisticated methods to adjust your Target Allocations through systematic signals.

MR isn't just a technique; it's a comprehensive framework for bringing institutional-quality discipline to your entire investment approach.

Both IR and MR benefit tremendously from modern trading innovations like zero-commission trades, fractional shares, and real-time portfolio tracking – practical advantages that weren't available to previous generations of investors.

IR provides the perfect starting point for index ETF investors who want meaningful improvement without significant complexity. Once you experience how this mechanical approach transforms market volatility from something to fear into a mathematical opportunity, you may find yourself naturally curious about the complete MR system and its expanded capabilities.

The question isn't whether market volatility will occur – it's whether you'll have a system in place to potentially benefit when it does.

🔄 What It Leads To:

Once you understand how to manage one position using this logic, you’re ready for the next step:

Micro-Rebalancing—where this process becomes fully mechanical, more dynamic, and adapted to modern trading tools.

Ready to take it further? Explore the Standard Edition of The Art of Micro-Rebalancing: The New Financial Frontier

or unlock even more tools with the special VIP Access Edition of The Art of the Micro-Rebalance: The New Financial Frontier.

How does Micro-Rebalancing Differ from Traditional Rebalancing?

How Does MR Differ From Traditional Rebalancing?

MR Transforms Investing Beyond Traditional Rebalancing

Investing in the stock market has evolved dramatically in recent years. While traditional portfolio rebalancing has served investors well for decades, modern investing demands more sophisticated approaches. Micro-Rebalancing (MR), as described in The Art of the Microbalance: The New Financial Frontier, represents the next evolution in managing equity positions.

Traditional Portfolio Rebalancing vs. Modern Micro-Rebalancing

Traditional Portfolio Rebalancing:

- Operates at the broad asset class level (stocks vs. bonds vs. cash)

- Typically performed quarterly or annually on a predetermined calendar schedule

- Resets portfolio back to target percentages (e.g., 60% stocks, 40% bonds)

- Ignores market movements between scheduled rebalance dates

- Incurs higher transaction costs due to larger, less frequent trades

- Limited by whole-share trading and commission structures

- Applied primarily to broader asset classes rather than individual ETFs

Micro-Rebalancing (MR):

- Functions at the individual position level (specific stocks, ETFs, or other suitable assets)

- Event-driven rather than calendar-driven - responds when trigger thresholds are crossed

- Uses Target Allocations (TAs) and price deviation triggers for each position

- Dynamically adjusts to market movements when they exceed predetermined triggers

- Leverages zero-commission trading and fractional shares now available to retail investors

- Provides more precise position management for low-cost index funds

- Follows mechanical, rules-based protocols that remove emotional decision-making

- Proven effective through real-world implementation with SPY stock and other index ETFs

How Often Should You Rebalance Your Portfolio?

With traditional rebalancing, investors adjust their holdings on fixed monthly, quarterly, or annual schedules regardless of market conditions.

Micro-Rebalancing takes a smarter approach to investing:

Actions occur only when a position's value (like SPY stock) crosses predetermined trigger thresholds

During volatile markets: More frequent adjustments capture value from price movements

During stable markets: Positions may require no adjustments for extended periods

With tighter trigger settings (e.g., 1%): More frequent rebalancing opportunities

With wider trigger settings (e.g., 5%): Less frequent adjustments for lower-maintenance ETF investing

This responsive approach means your portfolio adjusts naturally to market conditions rather than following arbitrary calendar dates.

Benefits of Micro-Rebalancing for Modern Investing

- Enhanced precision: Manages individual positions rather than just broad asset classes

- Market responsiveness: Adapts to price movements in real-time

- Emotional discipline: Removes psychological biases through consistent mechanical rules

- Operational efficiency: Uses smaller, targeted adjustments rather than portfolio-wide resets

- Customization options: Allows different trigger settings for personal customization based on volatility

- Modern compatibility: Maximizes benefits of today's zero-commission and fractional share capabilities

- Verified performance: Backed by documented trades with real positions

Does Micro-Rebalancing Replace Traditional Asset Allocation?

No. For serious investing, Micro-Rebalancing builds upon rather than replaces fundamental asset allocation principles:

Traditional asset allocation establishes your foundation of how investments are divided among major asset classes, including individual equities.

Micro-Rebalancing provides the operational system for managing individual positions more precisely and dynamically.

Together, they form a comprehensive investment management approach for today's modern investor – traditional allocation provides the strategic framework, while Micro-Rebalancing offers the tactical execution methodology.

Is Micro-Rebalancing Too Time-Intensive for Average Investors?

While Micro-Rebalancing involves more frequent transactions than traditional quarterly or annual rebalancing, it's designed to be efficient for modern investing:

The decision-making process is systematic and rules-based

Modern portfolio tracking tools alert you when positions cross trigger thresholds

The mechanical nature means decisions are predetermined rather than requiring complex analysis

Zero-commission platforms and fractional shares make execution simple and cost-effective

The initial setup requires defining Target Allocations and trigger percentages for your portfolio, but the ongoing management follows clear rules that remove subjective judgment calls, making it accessible for both new and experienced investors.

How Does Micro-Rebalancing/Index Rebalancing Improve Buy & Hold Index Investing?

Why Micro-Rebalancing Works Better Than Simply Holding Index ETFs

Many investors wonder why they should adopt a Micro-Rebalancing (MR) approach rather than just buying and holding index ETFs like SPY stock or QQQ stock. This is a reasonable question, especially since buy-and-hold investing with low cost index funds has been widely promoted as an optimal strategy for long-term investors.

The Limitations of Buy-and-Hold Investing

While buying and holding S&P 500 ETFs or other positions is certainly better than many alternative strategies, it has several inherent limitations:

Market Volatility Goes Unutilized: When you simply hold SPY, individual stocks, or other ETFs, natural market volatility becomes a source of stress rather than opportunity. Price movements in either direction serve no mechanical purpose in your investment strategy.

No Systematic Response to Market Conditions: Buy-and-hold provides no framework for responding to significant price movements in your positions. Whether your QQQ stock position drops 10% or rises 15%, the strategy offers no mechanical response.

Emotional Decision-Making: Without a rules-based system, many buy-and-hold investors end up making impulsive decisions during market extremes, often buying high and selling low despite their initial intentions.

Capital Deployment Challenges: Investors frequently struggle with timing additional investments, often leaving cash uninvested for too long or deploying it all at once at suboptimal times.

How Micro-Rebalancing Improves Upon Buy-and-Hold

Micro-Rebalancing transforms these limitations into advantages:

1. Volatility Becomes an Asset, Not a Liability

With MR, market volatility in your SPY stock or other index fund positions becomes useful. Each time your position value crosses a trigger threshold:

Downward movements trigger systematic buying at lower prices

Upward movements trigger systematic selling at higher prices

This mechanical approach ensures you're consistently buying lower and selling higher without trying to time the market.

2. Disciplined Capital Deployment

Rather than guessing when to add more money to your ETF positions, MR provides clear triggers for deploying capital. When your S&P 500 ETF drops below its trigger threshold, you add a precise amount to restore the Target Allocation.

3. Emotionless, Rules-Based Decision Making

The MR system eliminates emotional responses to market movements. When your QQQ stock position rises or falls dramatically:

You don't need to decide whether this is "the top" or "the bottom"

You simply follow the mechanical rules based on your pre-determined triggers

Your actions are consistent and methodical rather than reactive

4. Documented Real-World Results

Unlike theoretical investing approaches, Micro-Rebalancing has been implemented with actual ETF positions in real brokerage accounts. The proof pages on IndexRebalancing.com show actual trade confirmations that demonstrate the system's practical application with SPY stock and other index ETFs.

Is MR Significantly More Work Than Buy-and-Hold?

While MR requires more transactions than pure buy-and-hold, modern zero-commission brokerages and fractional share capabilities make this essentially frictionless. The time investment is minimal compared to the potential benefits:

Initial setup of Target Allocations and triggers

Occasional position adjustments when thresholds are crossed

Simple tracking of position values relative to triggers

The system's mechanical nature means decisions are predetermined rather than requiring complex analysis for each market movement.

Bottom Line: A Smarter Approach to Index Investing

Micro-Rebalancing doesn't contradict the fundamental wisdom of index investing—it enhances it. By adding a mechanical framework to manage ETF positions like SPY stock and QQQ stock, MR allows investors to:

Systematically capture value from natural market volatility

Maintain discipline through emotional market periods

Deploy capital efficiently and methodically

Follow a proven system with real-world implementation

Rather than simply holding index funds and hoping for the best, Micro-Rebalancing provides a logical, systematic approach to extract more value from the same ETF positions while reducing emotional decision-making.

Is Index Rebalancing or Micro-Rebalancing Difficult?

Is Performing Micro-Rebalancing Difficult for Investors?

Some investors considering Micro-Rebalancing (MR) for their investing strategy wonder about the complexity and time commitment involved. The straightforward answer is no—Micro-Rebalancing is not difficult to implement, but it offers layers of sophistication that can grow with your experience.

Although it is not difficult, Micro-Rebalancing does require time and effort if the process is not automated.

The Simplicity of Basic Micro-Rebalancing

At its core, Micro-Rebalancing follows a straightforward process with index funds like SPY stock or QQQ stock:

Set a Target Allocation (TA) - Decide on a fixed dollar amount for each ETF position

Define your triggers - Typically 1% to 5% above and below your TA

Monitor your positions - Track when your S&P 500 ETF or other positions cross these thresholds

Execute according to the rules - Buy when below the lower trigger, sell when above the upper trigger

With modern brokerage platforms offering zero-commission trades and fractional shares, the execution becomes remarkably simple. For the average investor managing a handful of low cost index funds, MR requires minimal time once the initial framework is established.

Layers of Customization for Advanced Investing

While the basic implementation is accessible to beginners, Micro-Rebalancing offers multiple layers of customization for more sophisticated investors:

Trigger Customization

Symmetrical triggers - Using the same percentage above and below TA (simplest approach)

Asymmetrical triggers - Different percentages for buy vs. sell triggers based on market conditions or volatility profiles of specific ETFs

Variable triggers - Adjusting trigger percentages based on market conditions or technical indicators

Target Allocation Adjustments

Static TA - Maintaining the same dollar commitment (beginner approach)

Dynamic TA - Systematically increasing TA amounts based on profits generated from the system

Condition-based TA - Modifying TAs based on broader market metrics or technical indicators

Position-Specific Customization

Different triggers for different ETFs - Using tighter triggers for less volatile ETFs like VOO stock and wider triggers for more volatile positions

Position-specific rules - Developing unique parameters for different index funds based on their characteristics

Advanced integration - Combining MR with other factors like seasonal patterns or market breadth indicators

Institutional Applications with Advanced Customization

For institutional investors, Micro-Rebalancing can incorporate sophisticated enhancements:

Integration with risk models and volatility forecasts

Custom trigger algorithms based on statistical deviation measures

Automated execution systems with API connections to brokerages

Complex position sizing frameworks for managing large ETF portfolios

Real-World Implementation Made Simple

Despite these potential complexities, most individual investors can benefit from Micro-Rebalancing with just the basic implementation. As documented in the proof pages on IndexRebalancing.com, even the straightforward application of MR principles to SPY stock and other index ETFs has demonstrated effective results.

The beauty of the system is its scalability:

Begin with simplicity - Start with basic symmetrical triggers and static TAs

Learn through experience - Understand how the system responds to different market conditions

Add sophistication gradually - Incorporate more advanced features as your comfort and understanding grow

Bottom Line for Investors

Micro-Rebalancing is as simple or as sophisticated as you choose to make it. The core mechanical concept is accessible to any investor, while the framework allows for continuous refinement and customization as your experience with index investing grows.

With modern trading platforms eliminating traditional barriers like commissions and whole-share requirements, implementing MR with your stock positions or index ETFs has never been more accessible, regardless of whether you choose the simple implementation or explore its more advanced applications.

Does it Take a Lot of Money to Start?

Does it Take a Large Investment to Get Started?

No!

Micro-Rebalancing can be done with any amount of money at commission-free brokers like Robinhood or Webull.

The system is designed to work with any amount of investment from $25 to $250,000,000 and beyond. The goal is to earn an improved percentage for your overall rate of return, regardless of the amount of the original investment.

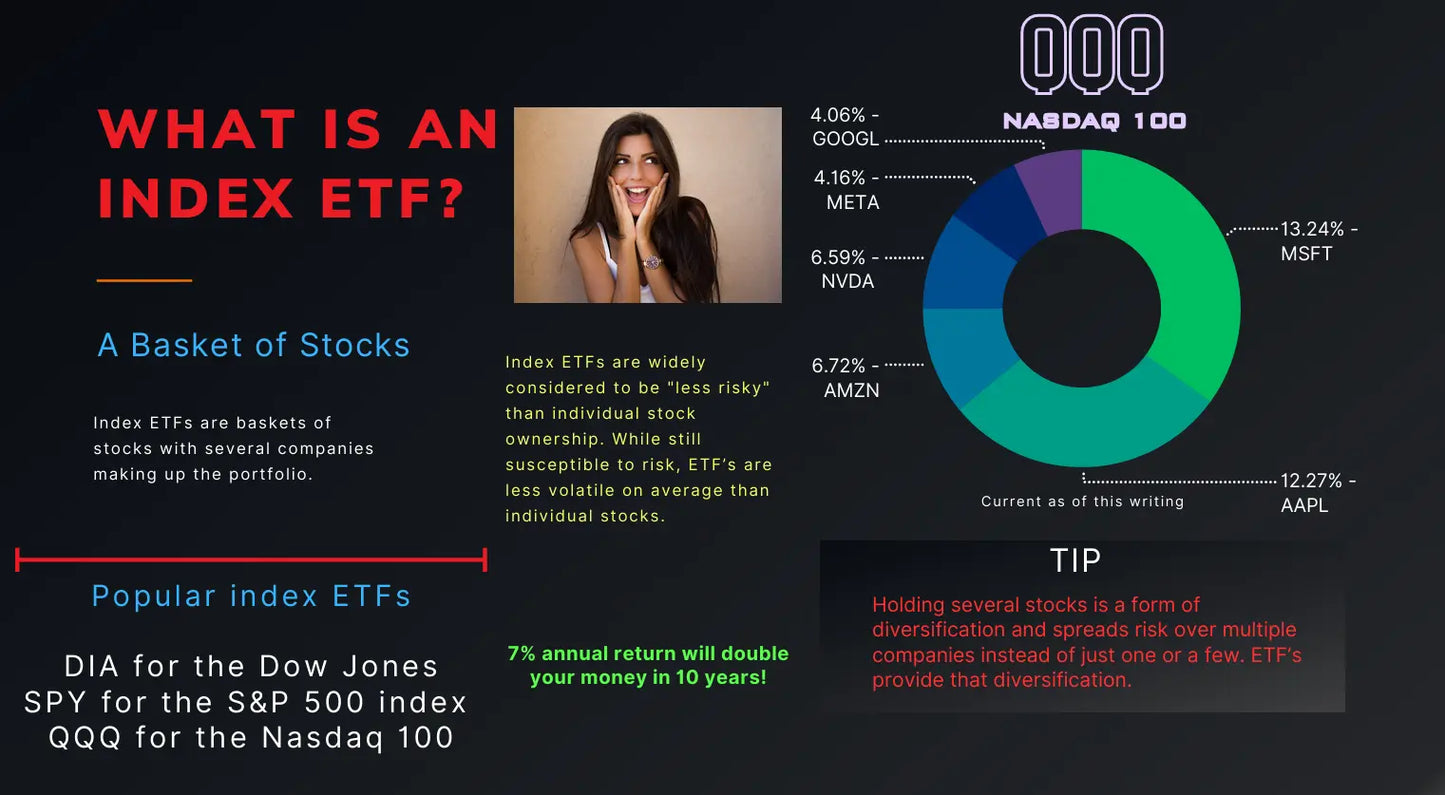

What is an Index ETF?

An index ETF, or Exchange-Traded Fund, is like a basket filled with many different stocks or bonds.

Instead of buying each stock individually, you can buy shares of one "basket" that holds them all.

Here's how it works:

An "index" is a group of companies that represent a section of the stock market.

For example, the Nasdaq-100 Index includes 100 of the biggest tech and non-financial companies listed on the Nasdaq exchange, like Apple, Microsoft, and Tesla.

An ETF is a fund that trades on the stock market just like a single company's stock.

Instead of representing one company, it holds a collection of companies.

The Invesco QQQ ETF (symbol: QQQ) is a real-world examples covered in this material.

It tracks the Nasdaq-100 Index by holding shares of all its companies.

When you buy a share of QQQ stock, you’re investing a little bit in every company in the Nasdaq-100.

It’s a simple way to invest in many companies at once—without needing to buy them separately.

✅ Advantages of Index ETFs

Buying an index ETF like QQQ or SPY spreads your investment across many companies, reducing individual company risk.

Index ETFs often have low fees because they passively follow an index instead of trying to pick winners.

You can trade ETFs throughout the day just like individual stocks.

ETFs adjust holdings automatically when the index changes, saving you the hassle.

Index ETFs often include big, stable companies, making them strong candidates for steady long-term investing.

⚠️ Disadvantages of Index ETFs

Because they simply track a list, you may miss out on huge gains from small breakout companies.

You’re invested in all companies in the index—whether you like them or not.

If the entire index drops, so does your ETF.

Even though they’re lower, ETFs still charge management fees that eat into returns over time.

Some ETFs, like QQQ, exclude certain sectors (e.g., financials, energy), meaning your exposure may be narrower than you think.

What is the difference between the S&P 500 SPDR ETF (SPY) and the Nasdaq-100 ETF (QQQ?)

🔍 What’s the Difference Between SPY and QQQ?

The QQQ and SPY are both popular ETFs (Exchange-Traded Funds), but they track different indexes and have distinct characteristics that affect their performance, volatility, and long-term purpose.

Here’s how they compare:

1️⃣ Index Tracked

Tracks the Nasdaq-100 Index, which includes 100 of the largest non-financial companies listed on the Nasdaq exchange. These are mostly in the technology, consumer discretionary, and healthcare sectors.

→ The QQQ stock price reflects companies like Apple, Microsoft, and Nvidia.

Tracks the S&P 500 Index, which includes 500 of the largest U.S. companies across all sectors. That means SPY includes financials, energy, utilities, and more.

→ The SPY stock price reflects broader U.S. market exposure.

2️⃣ Sector Exposure

Roughly 50% tech-weighted, with no financial companies. It’s more concentrated and tends to perform well when tech is thriving.

→ Higher growth potential, but also more volatility.

Offers diversified sector exposure across the U.S. economy. Financials, healthcare, energy, and utilities help balance out tech exposure.

→ Generally considered more stable than QQQ.

3️⃣ Growth vs. Stability

More growth-focused. Heavily influenced by fast-growing innovation-driven companies.

→ Higher potential gains—but also larger swings.

More stable. Includes large, established companies in multiple sectors.

→ More balanced returns with less extreme ups and downs.

4️⃣ Performance in Economic Cycles

May outperform during bull markets and tech booms.

Tends to hold up better during downturns due to its sector diversification.

5️⃣ Dividends

Pays lower dividends, since many tech companies reinvest profits into growth.

Offers a higher dividend yield, thanks to sectors like utilities and financials, which historically pay more consistent dividends.

🧠 Summary:

ETF

QQQ- Best for growth-focused investors who believe in tech and innovation, and can tolerate more volatility

SPY- Best for broad-market, stable investors seeking diversified exposure to the full U.S. economy with smoother long-term returns

Both ETFs are used extensively with Micro-Rebalancing.

QQQ stock and SPY stock each offer unique advantages depending on your market view and portfolio goals.

Index Rebalancing

Investing Made Easy: Introduction to Institutional Style Management

Share

Index Rebalancing

Index Rebalancing: The Smarter Way to Invest in ETFs

Share

Index Rebalancing

The Art of the Micro-Rebalance: The New Financial Frontier

Share

Index Rebalancing

Exclusive VIP Access - All Books | Lifetime Updates | Tools | Scripts | BEST VALUE

Share

Micro-Rebalancing Blog

View all-

Trump Accounts (Section 530A): How $1,000 at Bi...

A Policy That Could Create a Generation of Millionaires The federal government just launched something unprecedented. Starting July 5, 2026, every U.S. citizen born between January 1, 2025 and December...

Trump Accounts (Section 530A): How $1,000 at Bi...

A Policy That Could Create a Generation of Millionaires The federal government just launched something unprecedented. Starting July 5, 2026, every U.S. citizen born between January 1, 2025 and December...

-

What Is MicroRebalancing? Complete Guide for 2026

Introduction: Are You Ready for What's Coming? When Institutions Start Hedging... Pay Attention. Gold just hit an all-time high above $5,100 per ounce. Silver, likewise, has even outpaced gold and...

What Is MicroRebalancing? Complete Guide for 2026

Introduction: Are You Ready for What's Coming? When Institutions Start Hedging... Pay Attention. Gold just hit an all-time high above $5,100 per ounce. Silver, likewise, has even outpaced gold and...

-

Micro Rebalancing vs Buy and Hold: 2-Year Real ...

I tracked every single trade for over 800 days. Here's what happened when I rebalanced instead of just holding. The Setup In 2020, I started an experiment that most investors...

Micro Rebalancing vs Buy and Hold: 2-Year Real ...

I tracked every single trade for over 800 days. Here's what happened when I rebalanced instead of just holding. The Setup In 2020, I started an experiment that most investors...

-

Trump's Executive Order Opens 401(k)s to Privat...

President Trump's August 7th executive order just opened the floodgates to a $12 trillion market shift. The sweeping directive instructs the Department of Labor and SEC to expand access to...

Trump's Executive Order Opens 401(k)s to Privat...

President Trump's August 7th executive order just opened the floodgates to a $12 trillion market shift. The sweeping directive instructs the Department of Labor and SEC to expand access to...