Index Rebalancing

Index Rebalancing: The Smarter Way to Invest in ETFs

Index Rebalancing: The Smarter Way to Invest in ETFs

Couldn't load pickup availability

Index Rebalancing: The Smarter Way to Invest in ETFs

Stop watching your portfolio drift. Start capturing profits from volatility.

You've Done Everything Right... So Why Does It Feel Wrong?

You bought SPY and QQQ like the experts said.

You're diversified. You're patient. You're playing the long game.

But here's what they don't tell you:

While you hold through every crash and correction, the market is handing you opportunities to buy low and sell high—and you're letting them slip away.

What if there was a way to keep your index ETFs AND systematically capture gains from the volatility everyone else fears?

There is. It's called Index Rebalancing.

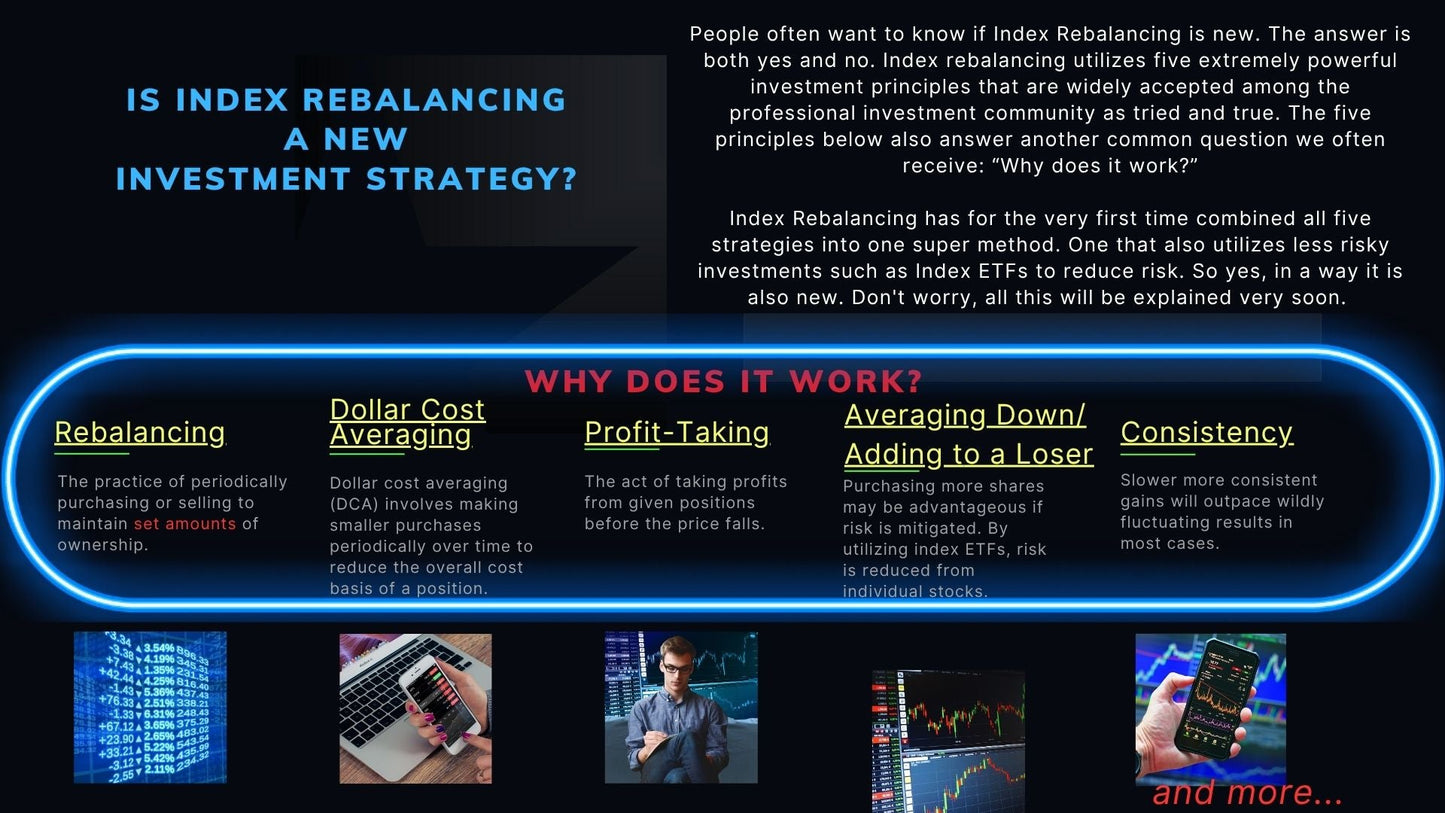

The Strategy That Couldn't Exist Until Now

For decades, traditional rebalancing meant waiting months or years to adjust your portfolio—because commissions and whole-share requirements made frequent adjustments impossible.

That era is over.

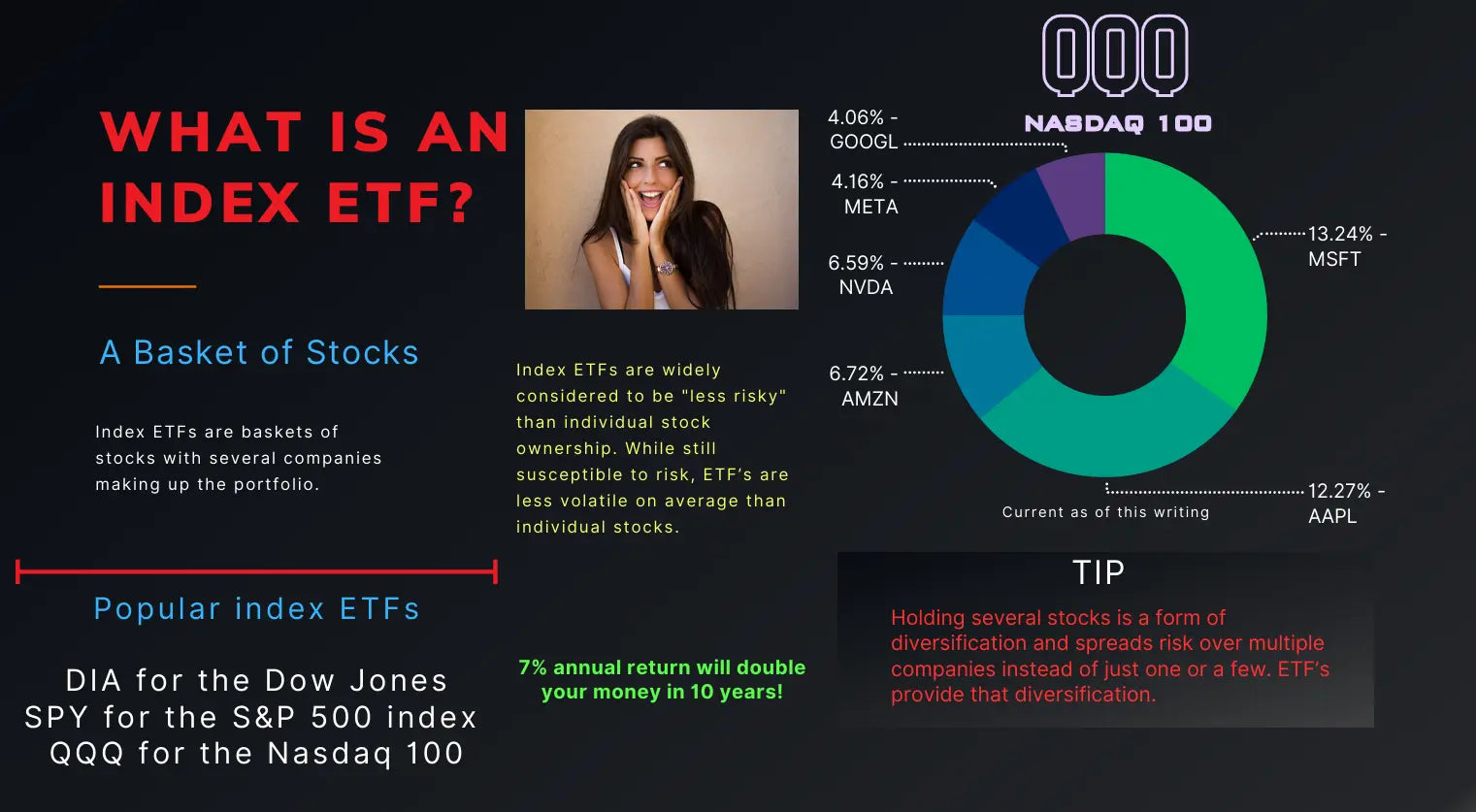

With fractional shares and zero commissions, you can now apply Micro-Rebalancing principles to index ETFs like SPY, QQQ, and VOO—turning market swings into systematic profit opportunities.

Index Rebalancing is your entry point to this new approach.

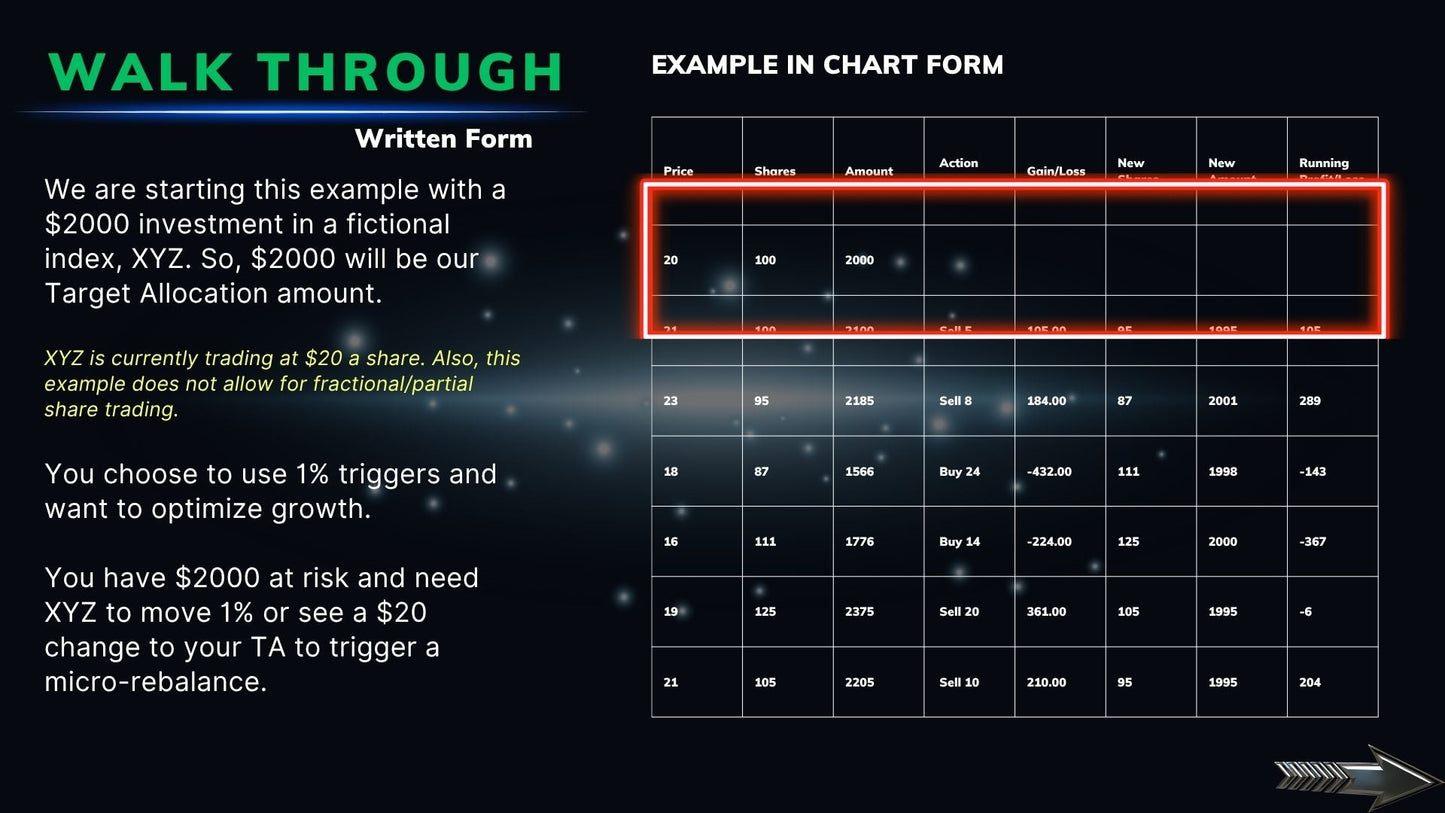

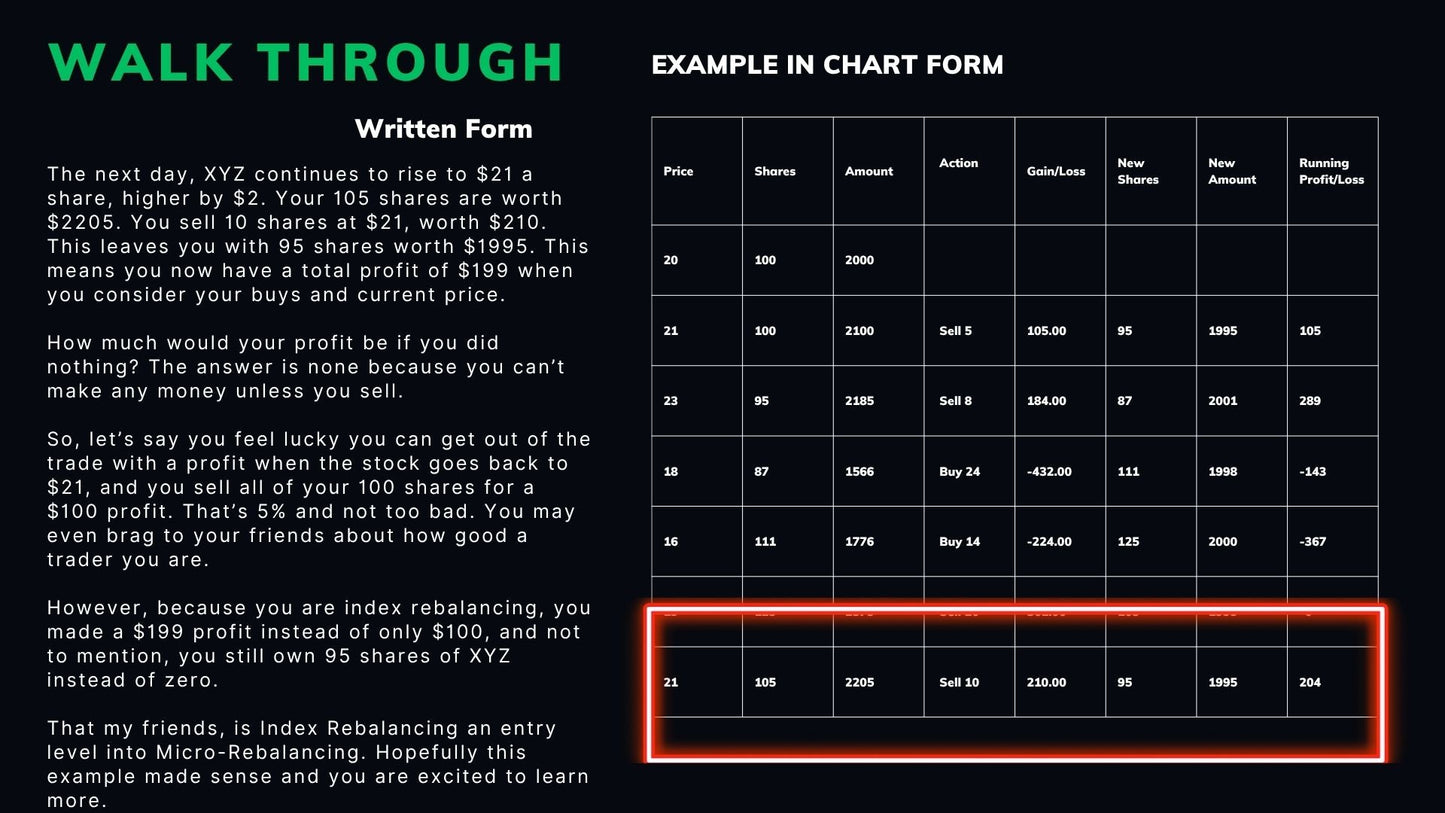

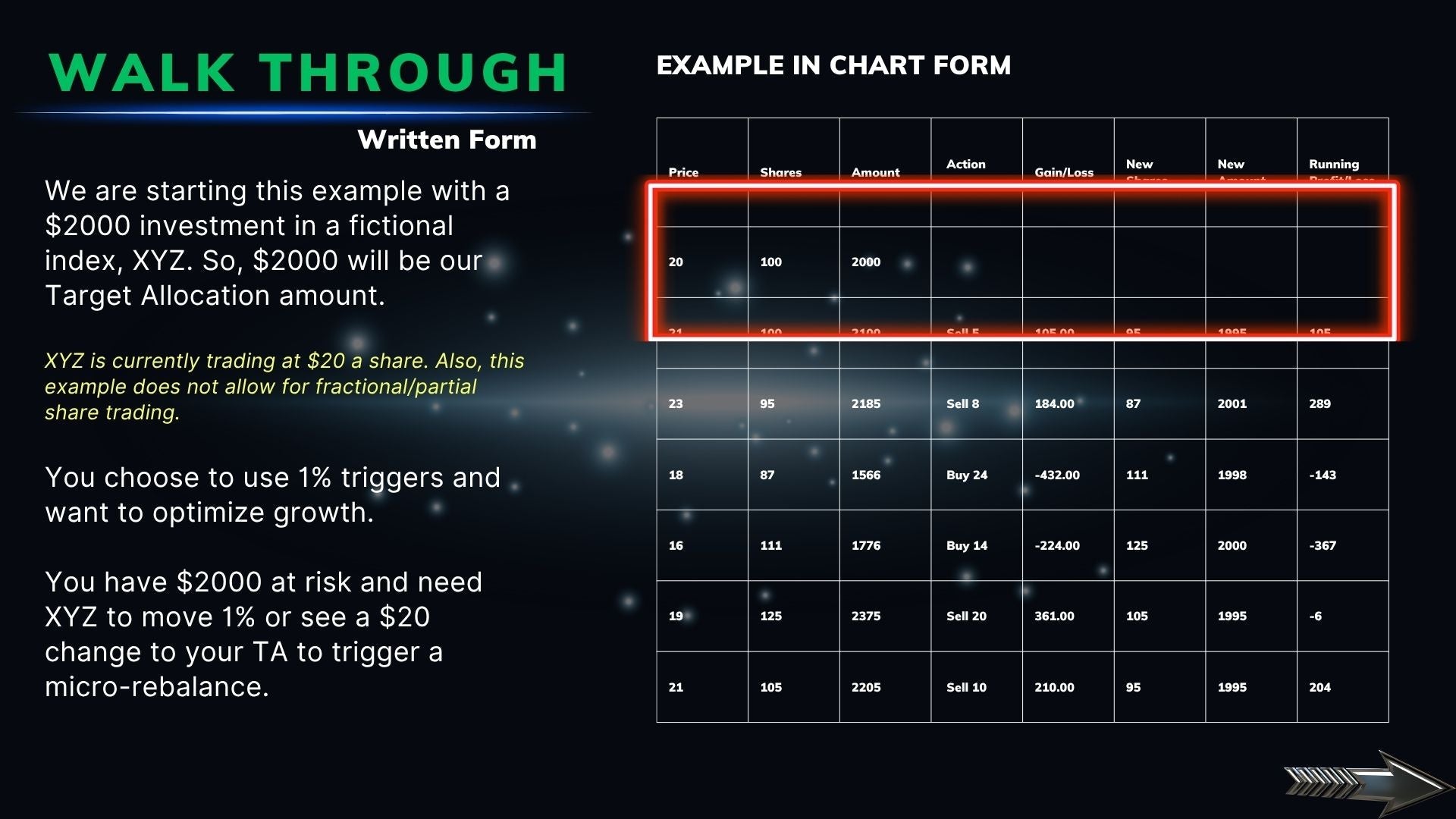

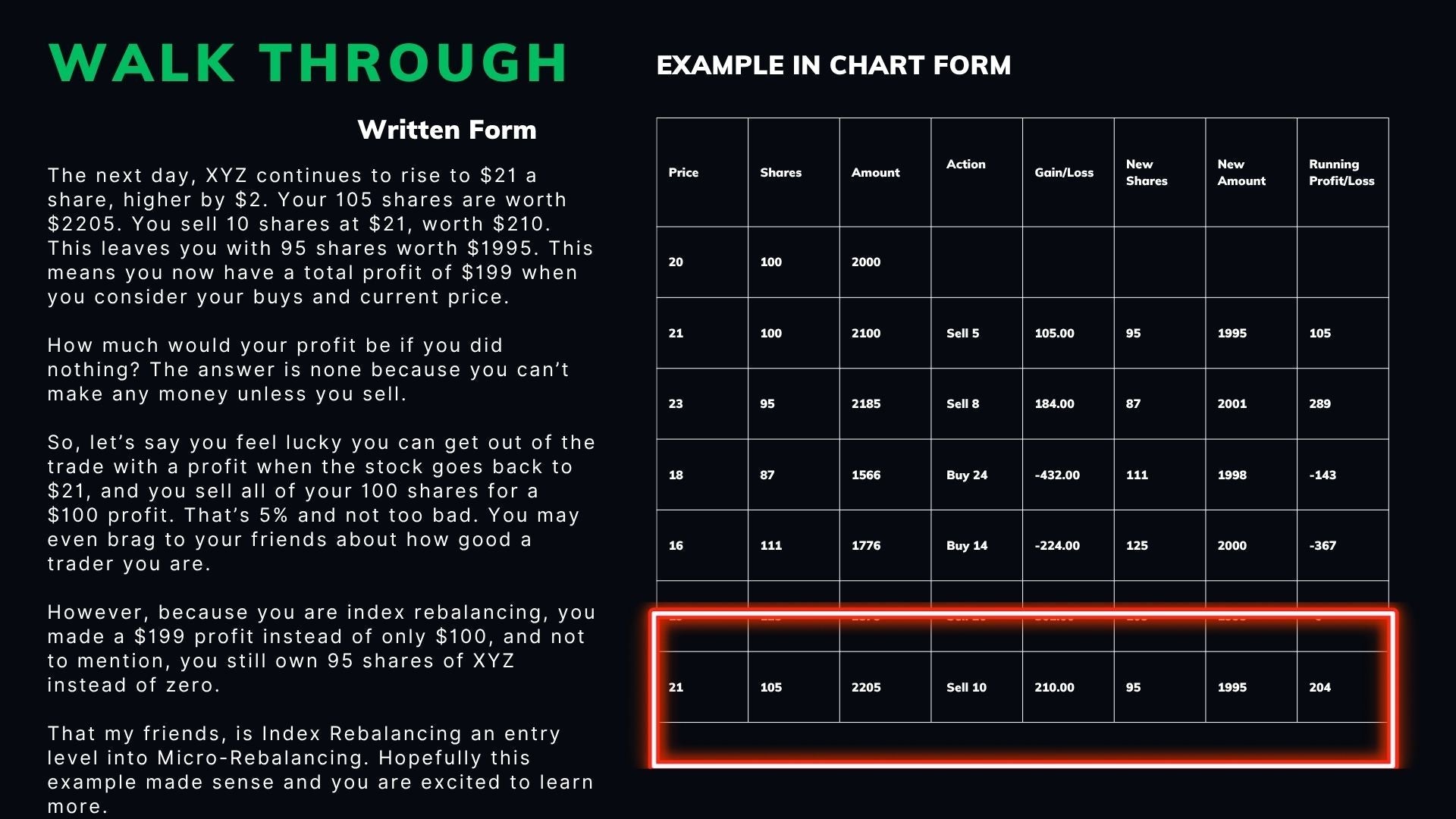

How It Works (In Plain English)

Traditional approach:

Buy $1,000 of QQQ. Hold forever. Hope it goes up. Watch it drop 20% in a correction and do nothing.

Index Rebalancing approach:

Buy $1,000 of QQQ. Set your Target Allocation at $1,000. Define your strike trigger points (buy and sell thresholds).

When QQQ drops below your buy trigger → Accumulate shares back to your Target Allocation (buying the dip automatically)

When QQQ rises above your sell trigger → Take profits and sell back to your Target Allocation (locking in gains systematically)

Result: You're forcing yourself to buy low and sell high—mechanically, without emotion, without predictions.

Real Results, Real Tracking

This isn't theory. This system has been:

✅ Tested on SPY through real market conditions

✅ Tracked on QQQ with spreadsheet verification

✅ Executed through 2020-2022 (bull run, COVID crash, sideways recovery)

See the proof:

What You'll Learn Inside This Guide

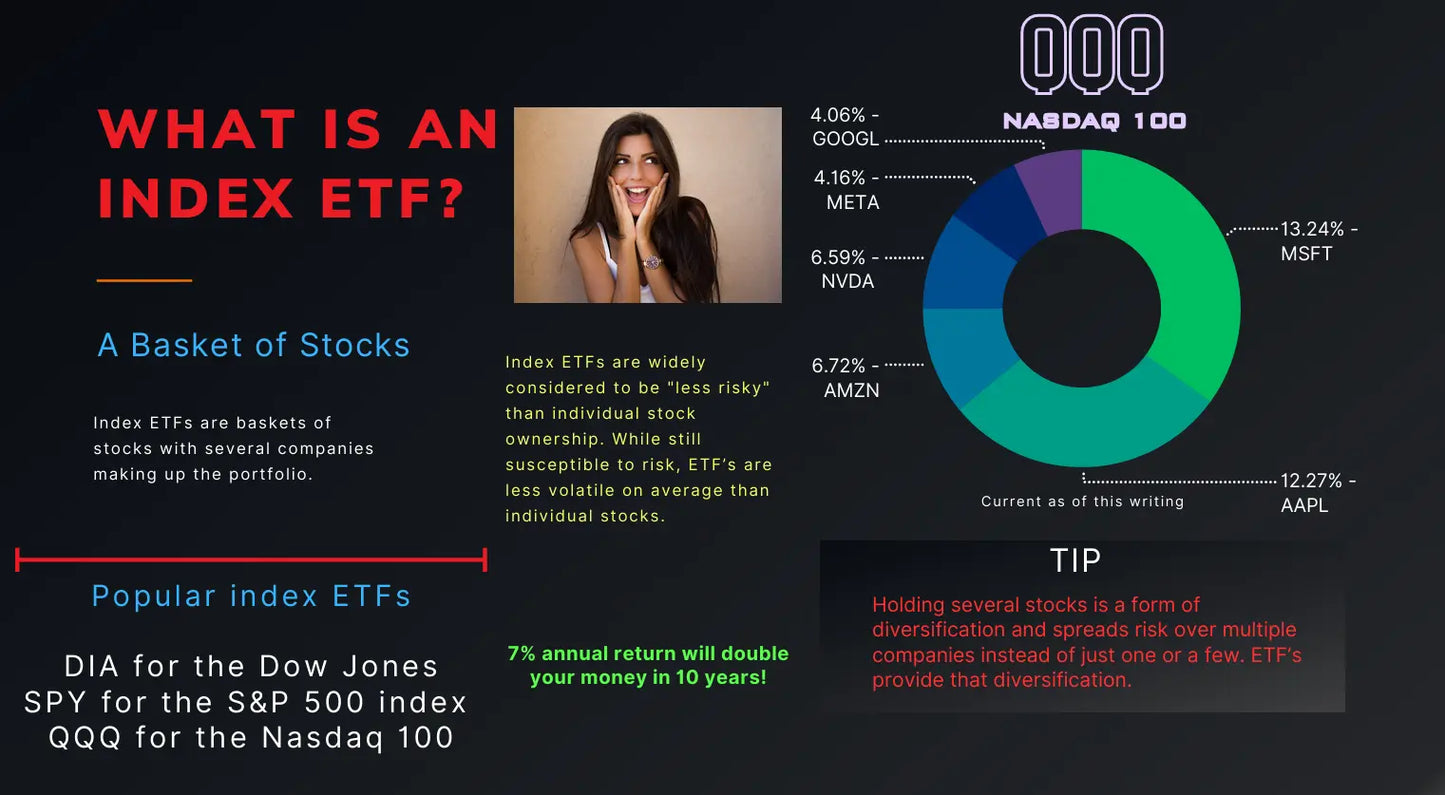

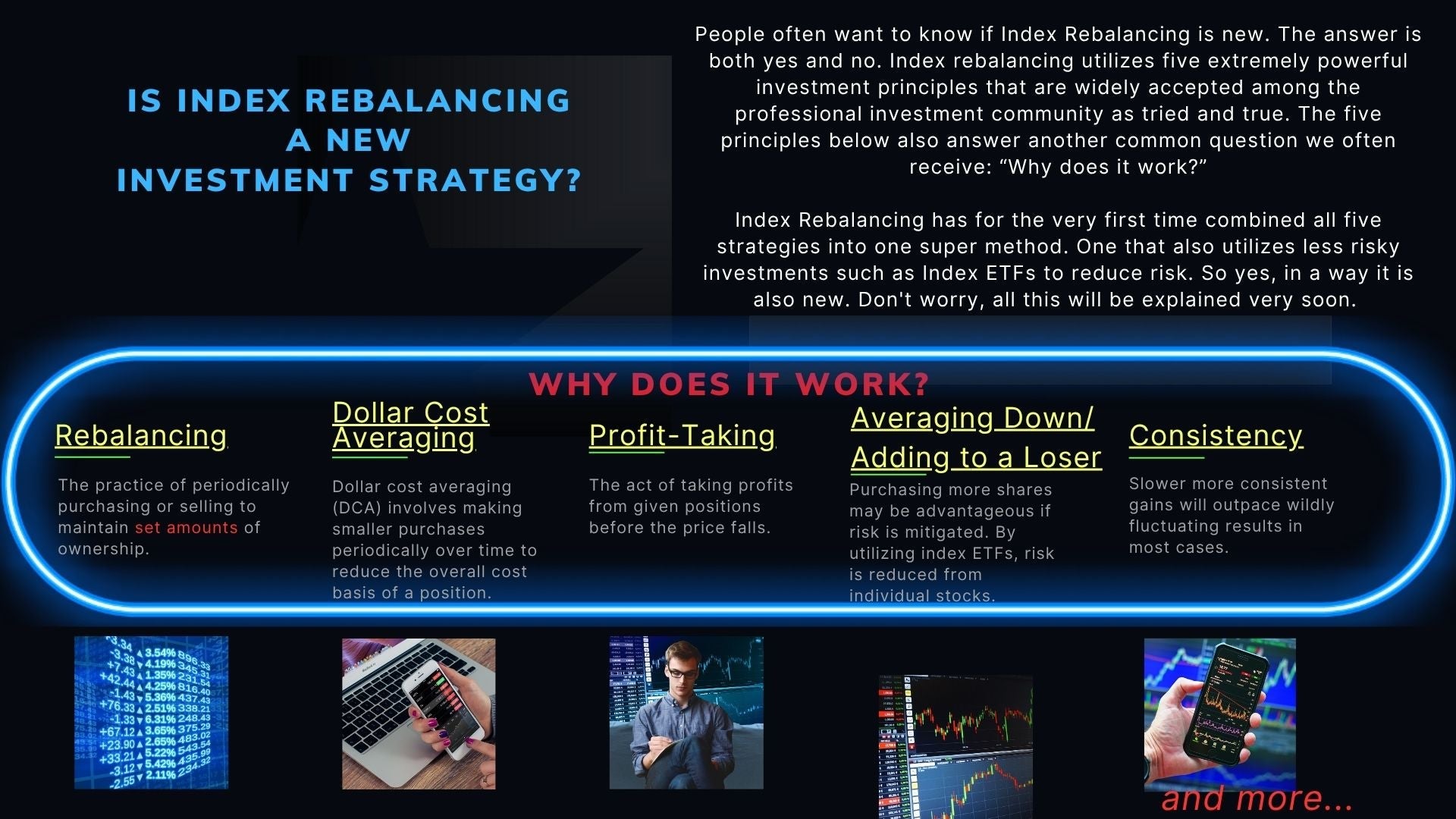

📘 The core logic behind Micro-Rebalancing and why it works with index ETFs

📘 How Target Allocation transforms volatility from a threat into a tool

📘 Strike trigger mechanics — when to buy, when to sell, and how much

📘 Dynamic optimization — adjust your system as your portfolio grows

📘 Why this strategy is only possible NOW — and why that matters for your future

Plus: Real-world examples using SPY and QQQ, tracked and spreadsheet-verified.

Who This Guide Is For

✅ You believe in index investing but want better results

✅ You're tired of watching gains evaporate in corrections

✅ You want intelligent control without abandoning core principles

✅ You value logic over guesswork and systems over emotion

✅ You're ready to explore the next evolution of index ETF investing

Perfect for beginners who want to start simple and scale when ready.

For young investors or those just starting out, ETF-based rebalancing is the perfect entry point:

- Instant diversification (SPY = 500 companies, QQQ = 100 tech leaders)

- Lower barrier to entry (can start with $100)

- Simpler execution (fewer positions to track)

- Learn the system safely (master mechanics before advancing)

Once you've proven the system works with ETFs, you can apply the same principles to individual stocks within a complete portfolio framework (covered in MicroRebalancing Standard Edition).

Think of it this way:

- IR = Learn to drive with automatic transmission

- MR = Master manual transmission with full control

Both get you where you're going. One is easier to learn. The other gives you more power once you're skilled.

Start here. Upgrade when ready.

This Is Your Entry Point

Index Rebalancing is the beginner-friendly gateway to the full Micro-Rebalancing system.

- Just 56 pages — fast, clear, immediately actionable

- PDF format — read on any device, start today

- No fluff — only the mechanics that matter

- Works with popular ETFs you already own or plan to buy

Why $5 Changes Everything

Regular price: $10

Limited-time sale: $5

For the cost of a coffee, you get a strategy that could transform how you invest for life.

What you're really buying:

- A system that survives market crashes

- A mechanical approach that removes emotion

- A foundation you can build on as you grow

This sale won't last. Once pricing returns to normal, this offer disappears.

The Choice Is Simple

Option 1: Keep holding through every correction, watching gains evaporate, hoping the market eventually rewards your patience.

Option 2: Download this guide, learn the system, and start capturing profits from volatility—today.

Traditional investing got us here.

Micro-Rebalancing is what comes next.

👉 Download Now — $5 (Limited Time)

Instant access. PDF format. Readable on any device.

Start smarter index ETF investing in the next 5 minutes.

[Add to Cart →]

Frequently Asked Questions

Q: Do I need to be an experienced trader?

A: No. This guide is specifically designed for beginners and long-term investors. If you can buy an ETF, you can use this system.

Q: Will this work with my current broker?

A: Yes. Any broker that offers fractional shares and zero commissions (Fidelity, Schwab, Robinhood, etc.) works perfectly.

Q: Do I need to change what I invest in?

A: No. This enhances how you manage positions you already own or plan to own (SPY, QQQ, VOO, etc.).

Q: How is this different from regular rebalancing?

A: Traditional rebalancing adjusts allocation between different assets (stocks vs bonds). Index Rebalancing adjusts your exposure within a single position based on price movements—capturing gains more frequently and systematically.

Q: What if I want the full Micro-Rebalancing system?

A: Start here with Index Rebalancing ($5), or jump to The Art of the Micro-Rebalance for the complete 270+ page guide with individual stocks and advanced strategies.

Welcome to The New Financial Frontier.

IMPORTANT DISCLAIMER

All information is intended for informational and educational purposes

only. It does not constitute financial, legal, or tax advice. The strategies,

systems, and examples included are past results and not guarantees of future performance and may not be suitable for every investor. All investments involve risk, including the possible loss of principal.

Consult a licensed financial professional before making any investment

decisions. The author and publisher are not responsible for any financial

outcomes related to the use of this material.

Share