Index Rebalancing

Index Rebalancing: The Smarter Way to Invest in ETFs

Index Rebalancing: The Smarter Way to Invest in ETFs

Couldn't load pickup availability

Index Rebalancing: Smarter ETF Investing

How to Use Micro-Rebalancing to Beat the Market Without Timing It

"Index Rebalancing is a General Introduction to a Smarter, Modern Strategy."

↗ Elevate Your Index ETF Investing

↗ Entry-Level System for Micro-Rebalancing using the exact SAME principles

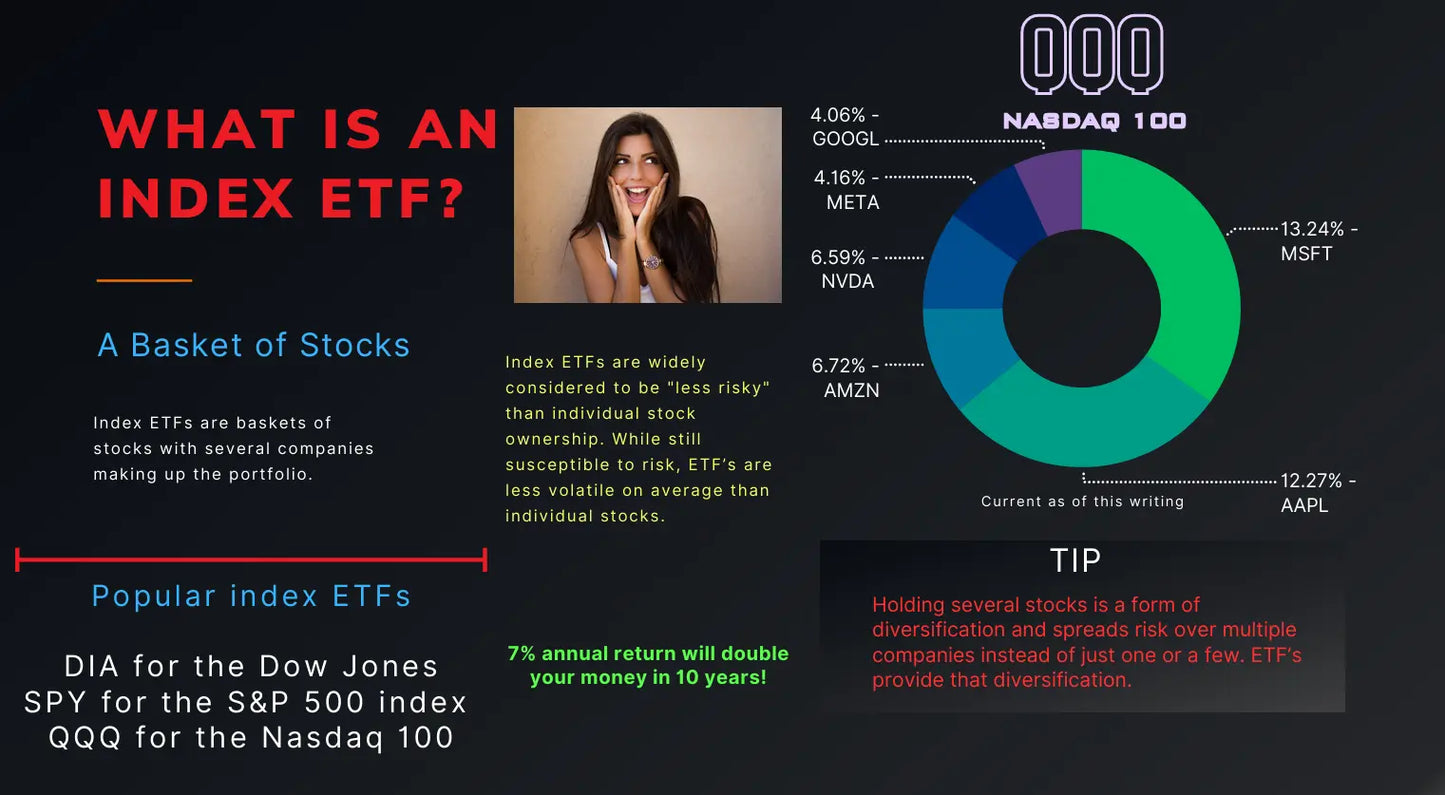

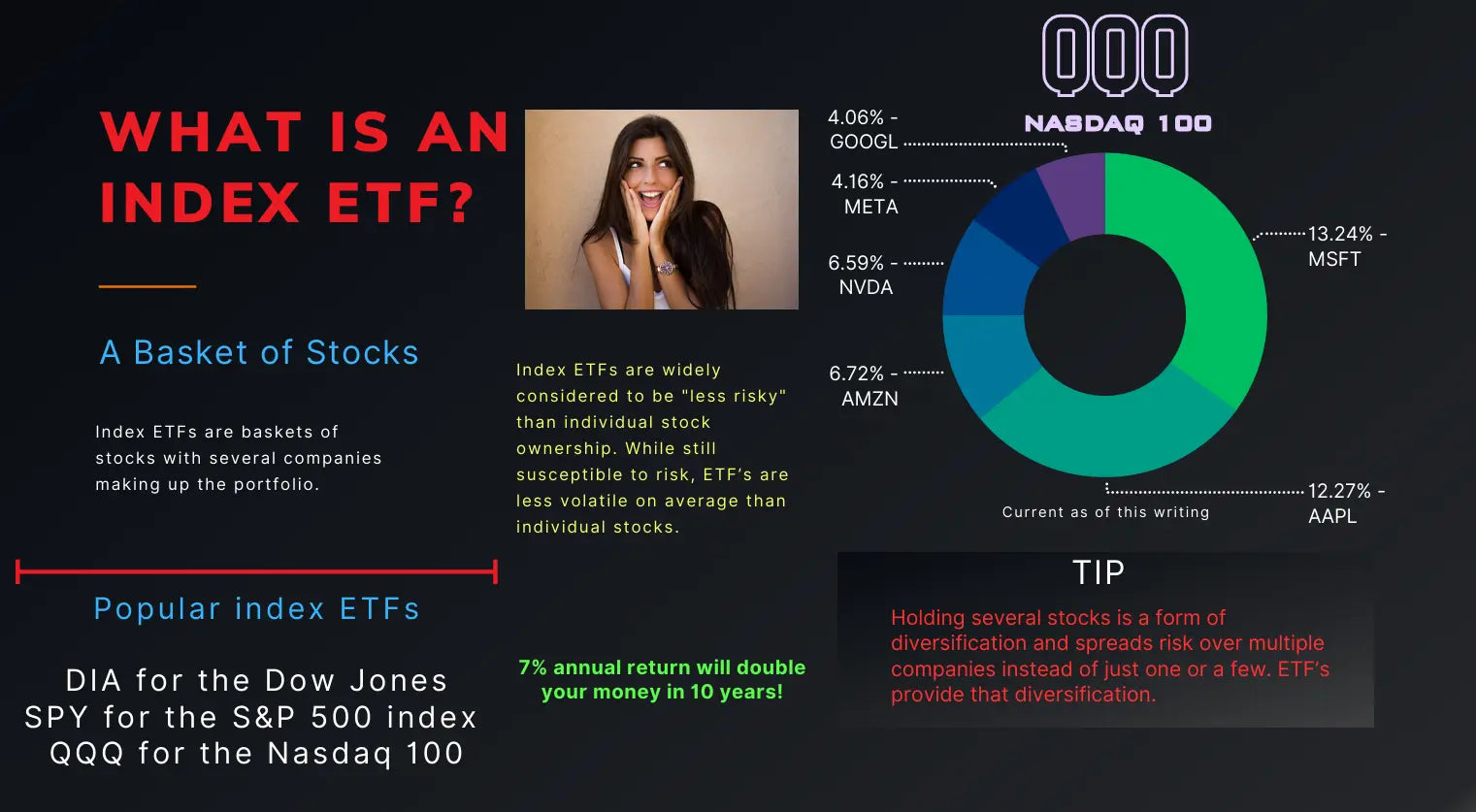

↗ Works great with popular Index ETFs like SPY, QQQ, and VOO.

For decades, the best advice for most investors has been championed by the likes of Warren Buffett: "Buy the index ETFs like SPY stock and QQQ stock consistently. Diversify wisely. Rebalance periodically."

It worked because it was the best system available, while lessening overall long-term risk for passive investors.

Until now.

You've followed the advice. You’ve bought into low-cost index funds. Now it’s time to optimize what comes next.

🔍 A Strategy Born for This Era

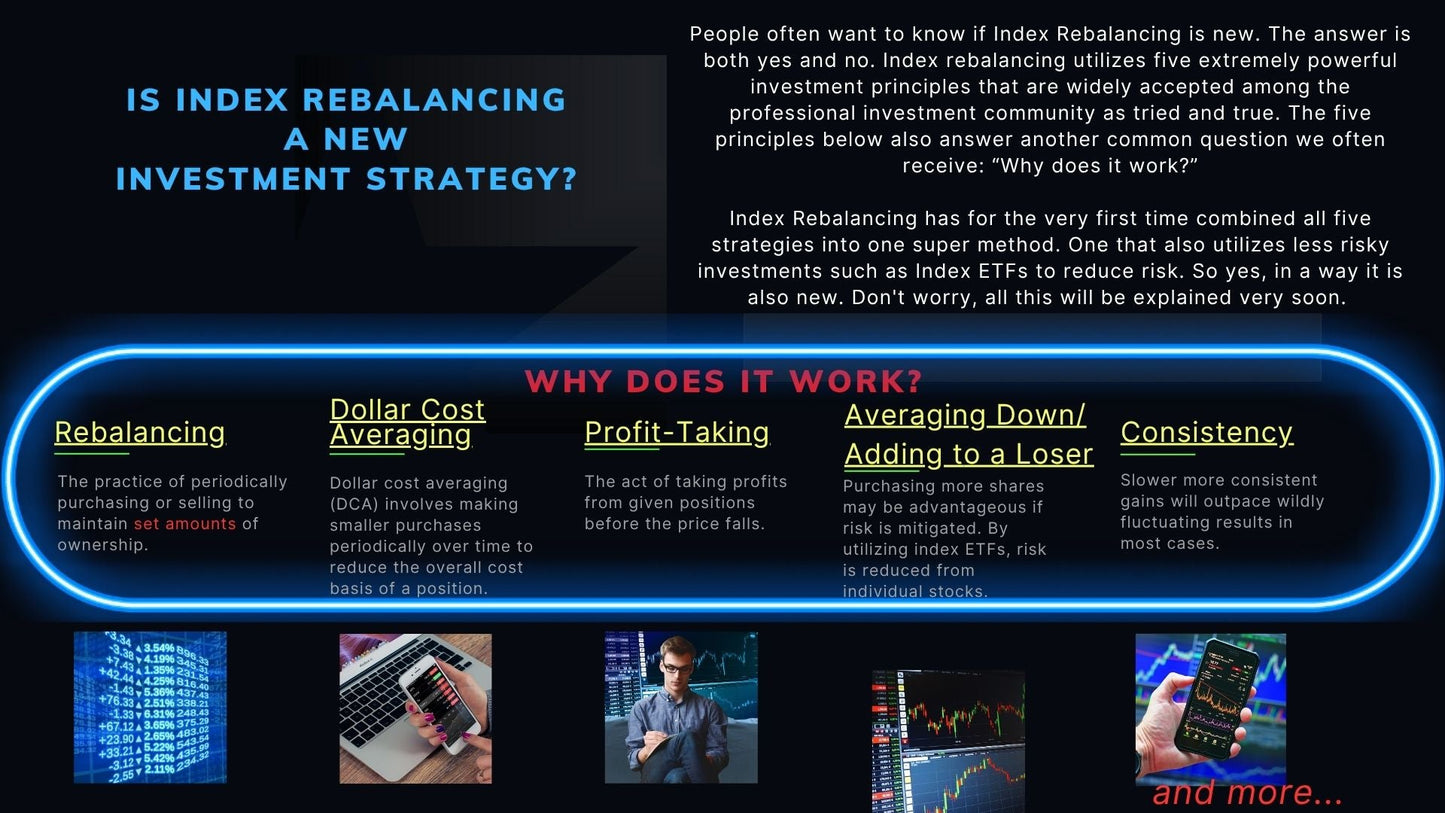

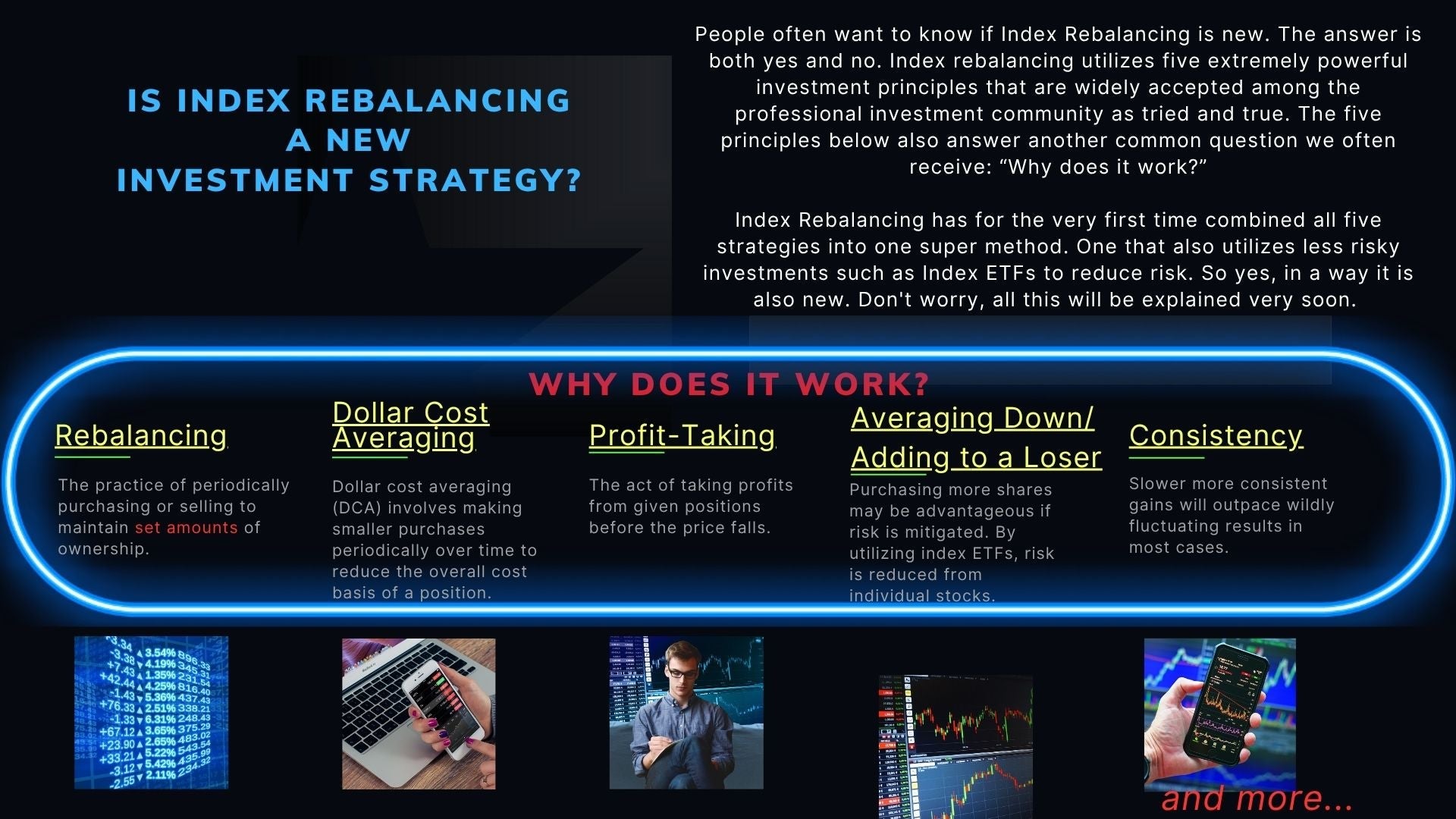

Index Rebalancing: An Introduction to Micro-Rebalancing is an entry-level guide to Micro-Rebalancing. It introduces a new layer of logic to index investing, one that couldn’t exist before fractional shares, zero commissions, and algorithmic execution were available to everyday investors.

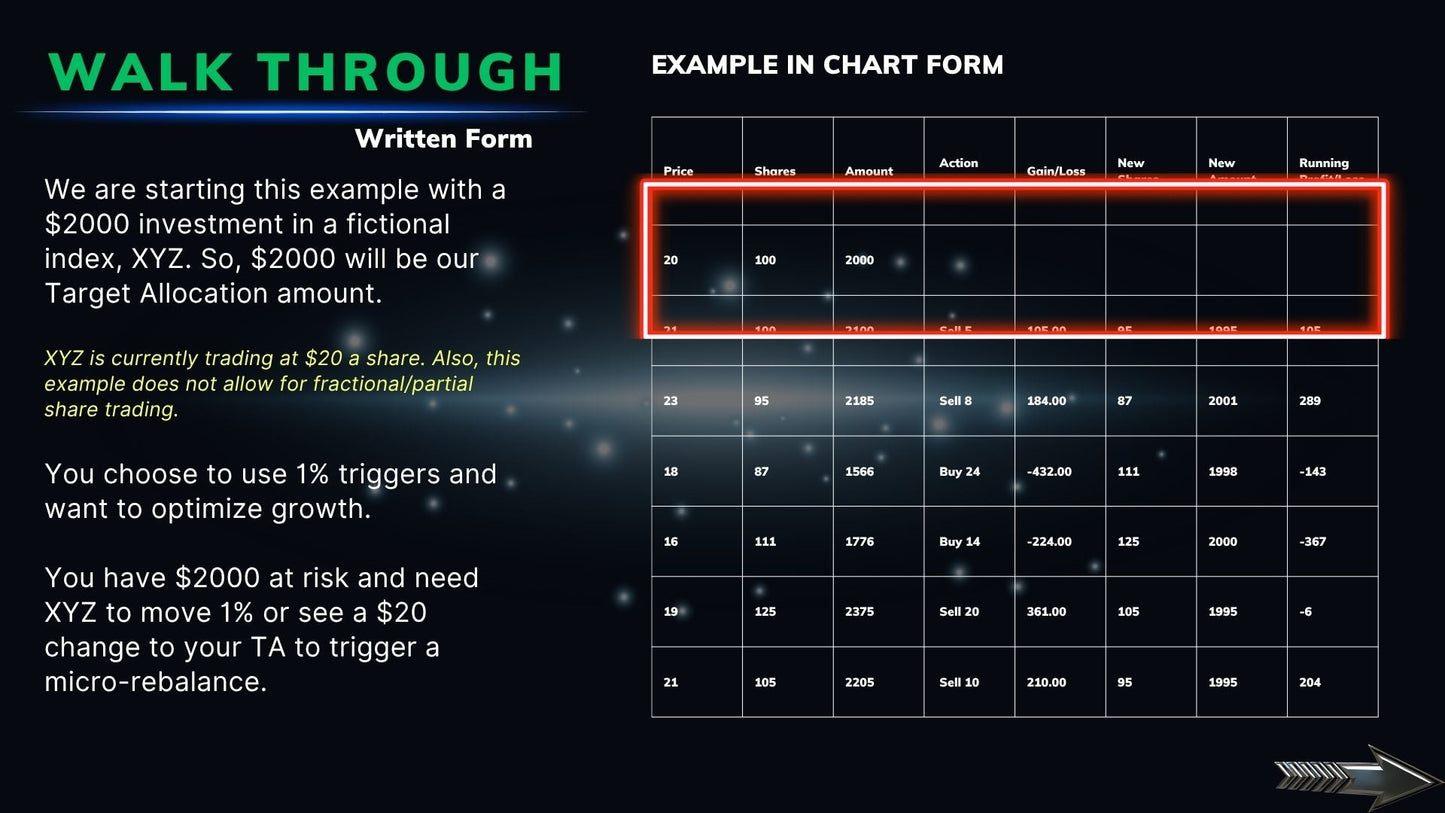

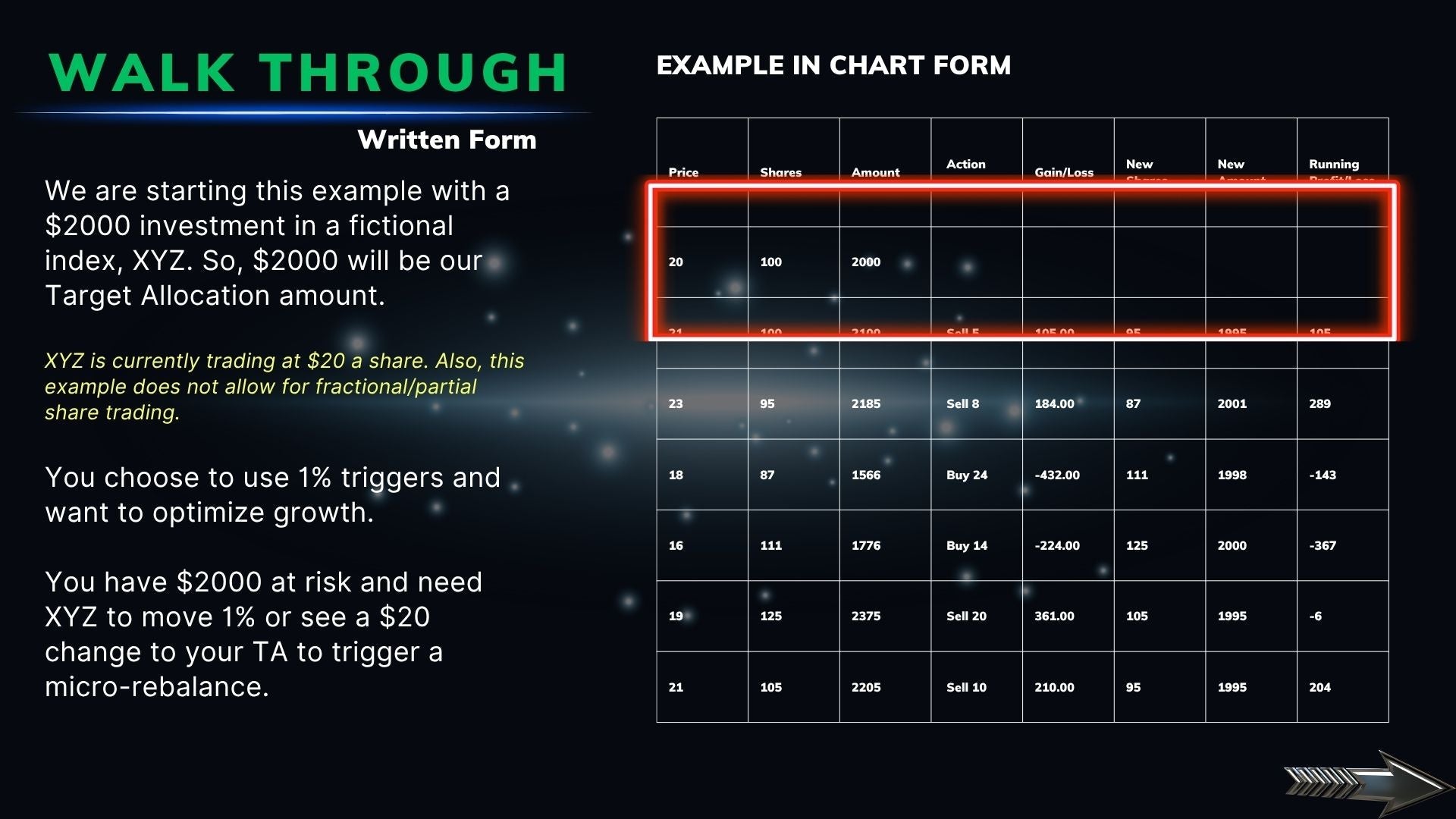

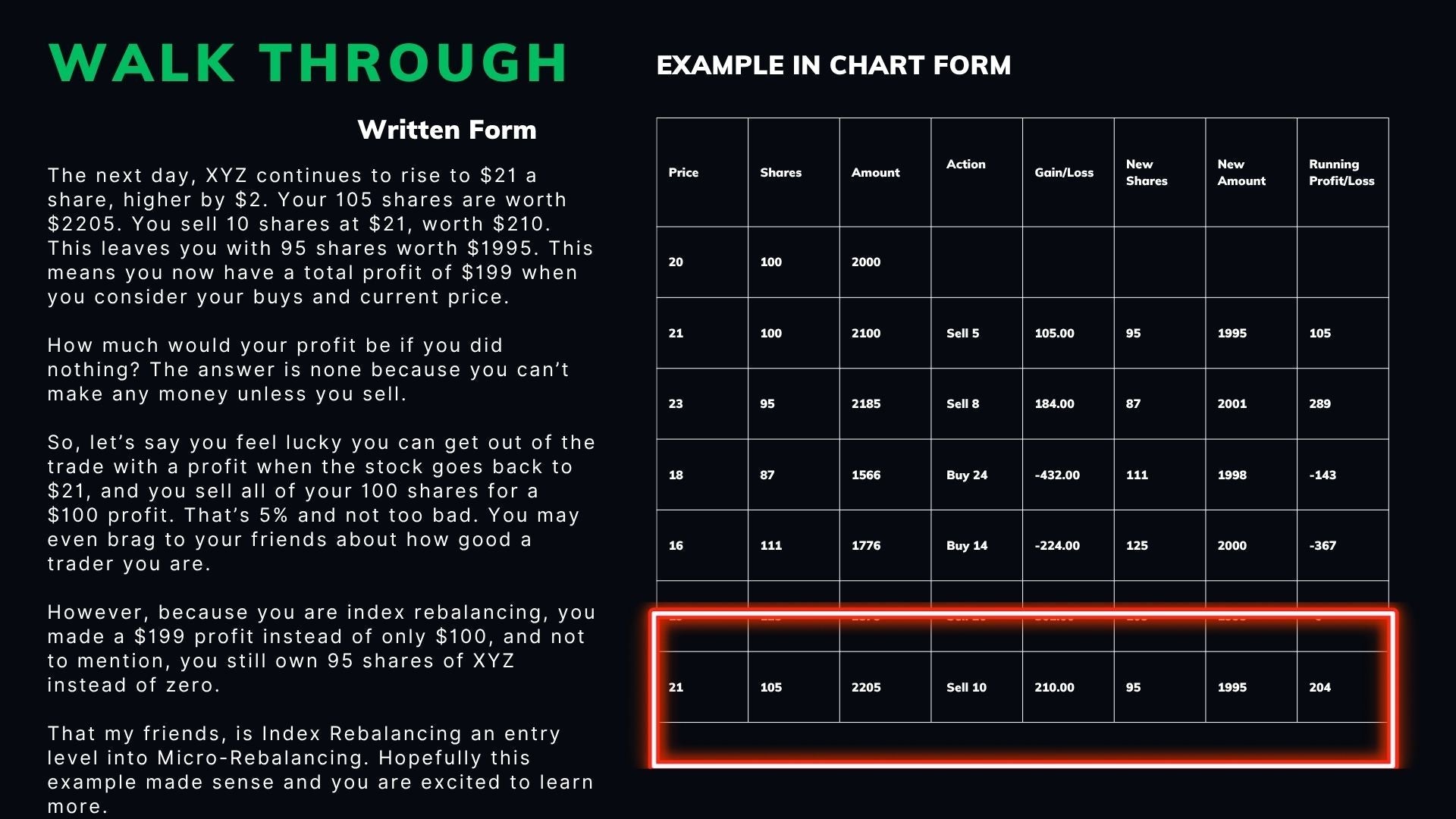

This guide gives you the foundation of Micro-Rebalancing (MR): a mechanical, rule-based system that adjusts your exposure to the market based not on forecasts, but on your current position relative to a fixed Target Allocation (TA).

For example:

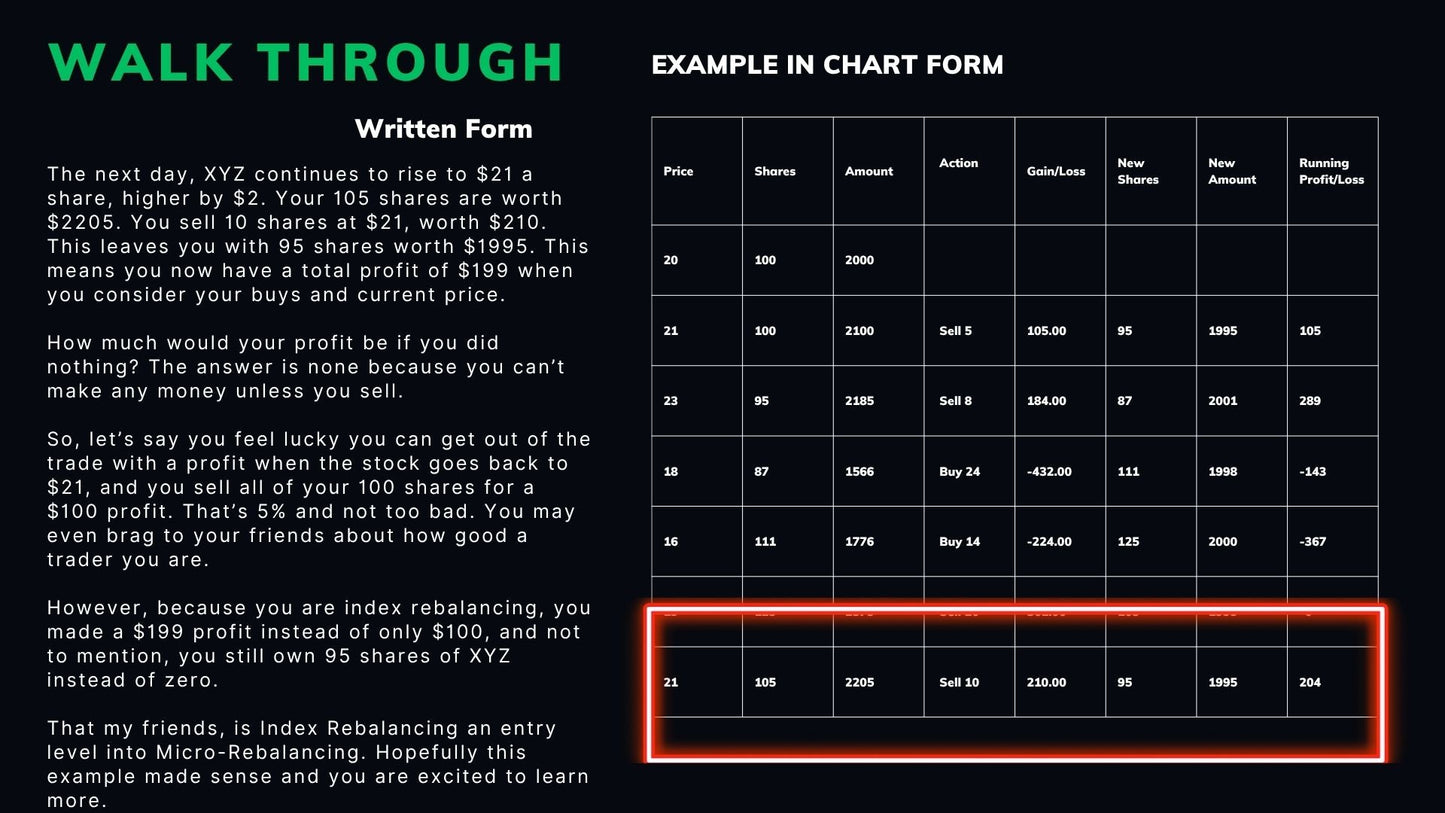

→ You invest $1000 into the QQQ index ETF. You set your Target Allocation at $1000. You will then determine your individualized strike trigger points (prices set both above and below the Target Allocation that will indicate when and how much to buy or sell).

↘ If QQQ stock price drops below your pre-determined strike trigger point, you accumulate enough of the position to get the amount invested back to your pre-determined Target Allocation.

↗ If the price of the index, in this case the QQQ, rises above your pre-determined sell strike trigger, you take profits and sell back to the customized Target Allocation. That’s it in a nutshell. you are essentially forcing yourself to buy at lower prices and to sell at higher prices.

No predictions.

No emotion.

Just pure simple math, disciplined, logical action in sync with your personalized goals. Micro-Rebalancing and Index Rebalancing are powerful because they are simple and easy enough for anyone to understand and implement.

Works with many other assets.

Includes real-world Micro-Rebalancing examples using the S&P 500 ETF (SPY): tracked, tested, and spreadsheet-verified.

-

View Index Rebalancing results on the Nasdaq 100 with QQQ stock- https://indexrebalancing.com/pages/micro-rebalancing-qqq

-

“See how MR handled the S&P 500 with SPY stock- https://indexrebalancing.com/pages/micro-rebalancing-spy

✅ Why This Guide Exists

This is the beginner’s gateway to a strategy that turns market volatility into opportunity, not by changing what you invest in, but by changing how you manage each position within your portfolio.

This isn't a trading tactic.

It’s an operational upgrade to traditional rebalancing—one that works within the existing system, but gives you new control over your results.

💡 What You’ll Learn Inside:

- The logic behind Micro-Rebalancing and how it enhances traditional strategies

- Why setting a static Target Allocation flips volatility from a threat to a tool

- How to personalize the system to custom-fit your own unique individual needs

- How to use dynamic Target Allocation and Strike Trigger points to maximize gains

- How this simple shift can improve performance, without changing your core holdings

- Why MR is only possible now and why it matters

📥 PDF Format – Instant Access

-

Readable on any device

-

No fluff—just a clear explanation of the system

-

Designed to be applied immediately or used as a stepping stone to more advanced strategies

🧠 For Readers Who:

- Beginners or new investors

- Believe in long-term index ETF investing, but want better tools

- Want to take intelligent control without abandoning core principles

- Value logic over guesswork

- Are curious enough to explore the next chapter in index and ETF investing

💵 Price: Just $5

Index Rebalancing is the entry-level version of the much larger and deeper Micro-Rebalancing system.

Normally priced at $10, it's available right now for just $5, making it accessible to anyone ready to explore something better. This is a limited-time offer, and pricing may be increased at any time.

Traditional investing got us here. Micro-Rebalancing is what comes next. Welcome to The New Financial Frontier.

👉 Download the guide now and take the first step toward smarter index ETF investing.

Share